The Trading Pit Reviews & Discounts 2024

The Trading Pit is a proprietary trading firm that offers funding opportunities for forex CFD and futures traders. Founded in 2022, it has quickly gained recognition in the prop trading industry, winning the title of Fastest Growing and Most Trusted Proprietary Firm in Europe in the same year.

The Trading Pit stands out for its flexible trading conditions, diverse account options, and innovative features like copy-trading and high-frequency trading support.

See the most recent sales and promotions for February 2025 below

The Trading Pit Pros & Cons

What we like:

- Clear and transparent rules

- No recurring monthly fees

- Fast payout processing

- High maximum account size ($5,000,000)

- Refundable challenge fee

- Overnight and weekend trading allowed

- Comprehensive educational resources

- Support for copy-trading and high-frequency trading

- Career advancement opportunities

What could be improved:

- No free trial or demo versions

- Rigorous qualification standards

- Limited leverage (capped at 1:20)

- Relatively low initial profit share (starting at 50-60%)

- Trading during news events not allowed

- Limited sales and discounts

The Trading Pit offers various account types for both forex CFD and futures traders. This review provides an in-depth analysis of the firm’s features, evaluation process, rules, and benefits.

Forex/CFD Challenges: Not Available to US Customers

- Lite Account:

- Starting balance: $10,000 (scalable to $500,000)

- Profit target: 10%

- Minimum trading days: 10

- Daily drawdown limit: 5%

- Maximum trailing drawdown: 10%

- Standard Account:

- Starting balance: $20,000 (scalable to $750,000)

- Similar rules to Lite Account

- Executive Account:

- Starting balance: $50,000 (scalable to $1,000,000)

- Two-stage evaluation

- Profit target: 8%

- Minimum trading days: 7

- VIP Account:

- Starting balance: $100,000 (scalable to $5,000,000)

- Two-stage evaluation

- Profit target: 8%

- Minimum trading days: 15

Futures Challenges: US Customers OK

- Lite Account:

- Starting balance: $20,000

- 30-day challenge (extendable to 90 days)

- Minimum trading days: 10

- Standard Account:

- Starting balance: $150,000

- 30-day challenge (extendable to 90 days)

- Minimum trading days: 15

- Executive Account:

- Starting balance: $150,000

- Two-phase evaluation

- Profit target: 2% per phase

- Contract size: 50 micros

- Minimum trading days: 10 per phase

- VIP Account:

- Starting balance: $250,000

- Two-phase evaluation

- Profit target: 1.2% per phase

- Contract size: 100 micros

- Minimum trading days: 7 per phase

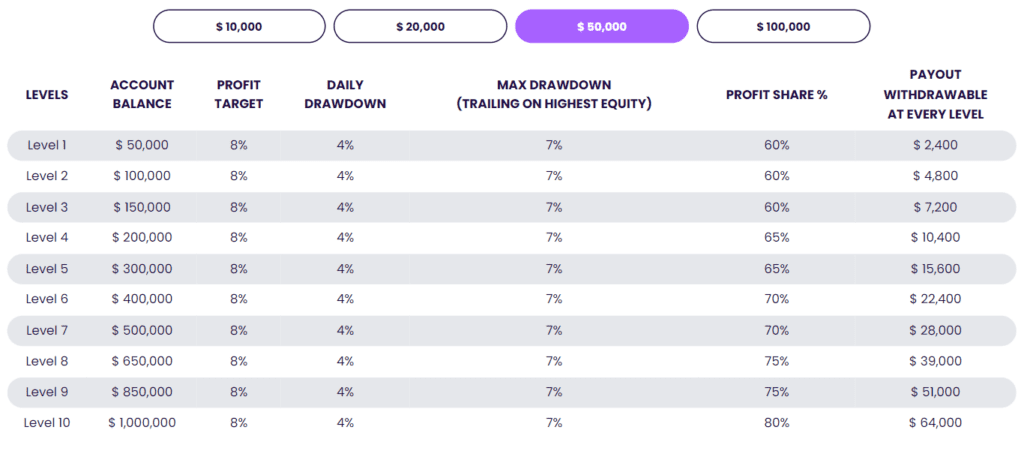

Profit Split and Scaling

- Forex: 50-80% profit split (depending on account type and scaling level)

- Futures: 60-80% profit split (depending on account type and scaling level)

- Scaling plans available for all account types

Trading Platforms

- Forex: MT4, MT5 (hosted by FXFlat)

- Futures: ATAS, Quantower, R | Trader

- Additional support for Sierra Charts, Jigsaw & Volx (licenses not provided)

- NinjaTrader

Unique Features

- Copy-trading and high-frequency trading support

- Overnight and weekend trading allowed

- Comprehensive educational resources (webinars, videos, blogs, glossaries)

- Trading tools: StereoTrader, Squawkbox, CME Heatmap, economic calendar

- Career advancement opportunities with asset management partners

Evaluation Process

- Forex: One-step evaluation (except for Executive and VIP accounts)

- Futures: Two-step evaluation

- Maximum 90-day challenge duration (with extension)

Withdrawl Policy

- Withdrawals available after meeting initial profit target

- No time constraints on meeting profit targets for funded accounts

- Profit share increases with scaling level

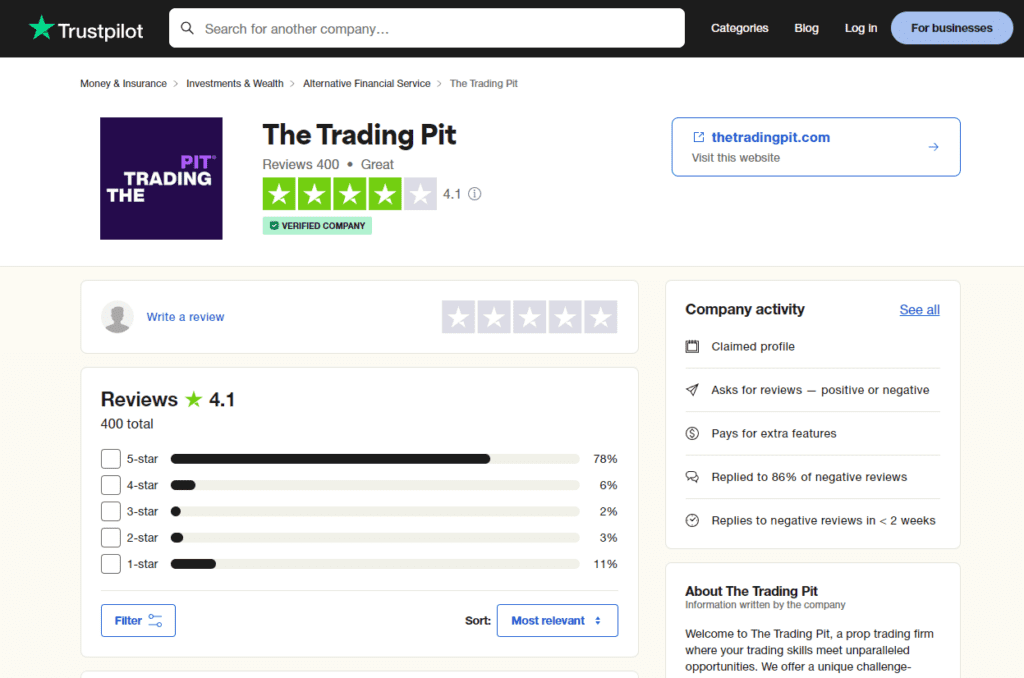

Trust Pilot Reviews and Statistics

Overall Rating Distribution

Summary of 86 reviews extracted

5 stars: 67 reviews (77.9%)

4 stars: 5 reviews (5.8%)

2 stars: 1 review (1.2%)

1 star: 13 reviews (15.1%)

Average Rating: 4.30 out of 5 stars

Key Themes and Statistics

- Customer Support:

- Positive support experiences: 30.2% of reviews praise customer support

- Fast response times: 11.6% mention quick response times

- Support quality: 8.1% specifically mention professional and knowledgeable support

- Platform and User Experience:

- 9.3% of reviews mention the platform’s ease of use or intuitiveness

- 5.8% praise the website design and functionality

- Payout Experiences:

- 11.6% of reviews mention successful payouts

- 5.8% mention fast payout processing

- Trading Challenges and Accounts:

- 12.8% of reviews discuss the evaluation process or challenges

- 8.1% mention the scaling plan positively

- Trading Rules and Conditions:

- 7% of reviews mention favorable or flexible trading rules

- 5.8% of reviews criticize rule changes or strict conditions

- Company Reputation and Trustworthiness:

- 10.5% of reviews express trust or confidence in the company

- 5.8% mention transparency as a positive aspect

- Negative Experiences:

- 8.1% of reviews mention account termination or breach issues

- 5.8% report issues with trade execution or platform performance

- Educational Resources:

- 3.5% of reviews mention educational resources or trader development positively

Key Points For Potential Traders

- Mixed Reviews: While the majority of reviews are positive (83.7% are 4 or 5 stars), there are some significant negative experiences reported.

- Strong Customer Support: The most frequently praised aspect is customer support, with many reviewers mentioning quick response times and helpful staff.

- Payout Reliability: Several traders report successful and timely payouts, though there are a few complaints about payout denials or delays.

- Evaluation Process: The company offers various challenge and evaluation options, which are generally viewed positively by traders.

- Scaling Plan: The scaling plan is mentioned as a positive feature by several reviewers, allowing traders to grow their accounts over time.

- Platform Options: TheTradingPit offers multiple trading platforms, including MetaTrader and options for futures trading.

- Rule Changes: Some negative reviews mention unexpected rule changes or strict enforcement of trading rules, which caused issues for some traders.

- Technical Issues: A small number of reviews report problems with trade execution or platform performance.

- Transparency: Several reviewers appreciate the company’s transparency, including visible management and clear communication.

- Educational Resources: While not frequently mentioned, some traders appreciate the educational resources provided.

Conclusion Of Trustpilot Reviews

TheTradingPit appears to be a legitimate prop trading firm with generally positive reviews, particularly regarding customer support and payout reliability. However, potential users should be aware of the mixed experiences reported, especially concerning rule changes and account terminations.

Traders should carefully review all terms and conditions, and be prepared for a potentially strict evaluation process. The company’s strengths seem to lie in its customer support, scaling plans, and variety of trading options. As with any prop firm, traders should approach with caution and thorough research before committing funds.

Conclusion

The Trading Pit offers an attractive proposition for both forex CFD and futures traders, with a wide range of account options to suit different experience levels and capital requirements. The firm’s innovative features, such as support for copy-trading and high-frequency trading, set it apart from many competitors. The comprehensive educational resources and trading tools provided can be particularly beneficial for traders looking to improve their skills.

However, prospective traders should be aware of the rigorous qualification standards and the relatively low initial profit share. The lack of a free trial option may also be a drawback for those wanting to test the platform before committing. As well as play close attention to the reviews and review summary.

Overall, The Trading Pit is best suited for disciplined traders who are comfortable with the firm’s rules and can take advantage of the scaling opportunities. The potential to trade with up to $5,000,000 in capital and the career advancement possibilities make it an attractive option for ambitious traders looking to grow their trading careers. This put the Trading Pit at #12 of the Top Prop Firms of 2024.

Key Takeaways

- Traders say they lost account inadvertently

- Low profit splits

- Empasis on consistency in trading style

- 30% daily consistency rule on PA accounts

- Clear Rules

- Crypto/CFD's/Multiinstrument

- Challenge Fees Refundable

- Largest prop trading firm

- Trade up to $5,000,000

- Live webinars and online training

- Ability to hold traders overnights and weekends

- Professional trader dashboard

- No reccuring monthly fees

The Trading Pit Discount / Coupon Codes

[table “” not found /]

The Trading Pit Restricted Countries

Burundi, Cuba, Iran, North Korea, South Sudan, Sudan, and the Syrian Arab Republic face restrictions. Additionally, there are limitations imposed by market data providers.

For futures trading, Rithmic does not open accounts for residents of Myanmar, Bonaire, Sint Eustatius and Saba, Sint Maarten, Afghanistan, Libya, Palestine, Iraq, Somalia, and Zimbabwe. Similarly,

DxFeed does not open accounts for residents of Iraq and Belarus.

For CFDs, challenges are not available to residents of the USA, Canada, and Russia

The Trading Pit Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools of 2025

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!