Elite Trader Funding Review 2026

See the most recent sales and promotions for Elite Trader Funding below

Elite Trader Funding is a proprietary trading firm established in 2022 in Delaware, USA. Founded by traders Eric Ho, Kanwal Singh, and Clint Chaney, the firm offers traders access to funded accounts ranging from $10,000 to $300,000.

Elite Trader Funding stands out for its flexible evaluation options, generous profit-sharing scheme, and the ability to manage up to 20 funded accounts through a single login. This review provides an in-depth analysis of the firm’s features, evaluation process, rules, and benefits.

Elite Trader Funding Evaluation Types

Evaluation Options:

- 1 Step Evaluation

- EOD Drawdown Evaluation

- Fast Track Evaluations

- Static Evaluations

- Diamond Hands Evaluation

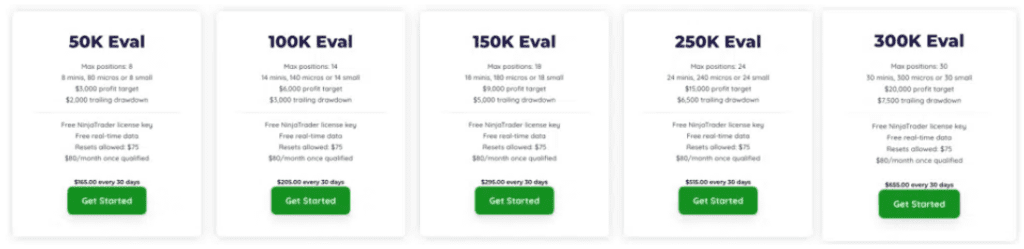

Elite Trader Funding offers various account sizes with corresponding profit targets:

- 50K Eval: $3,000 profit target

- 100K Eval: $6,000 profit target

- 150K Eval: $9,000 profit target

- 250K Eval: $15,000 profit target

- 300K Eval: $20,000 profit target

(Note: Exact drawdown limits and position sizes vary by account type and size)

Specific Evaluation Types

The 1 Step Evaluation by Elite Trader Funding provides a streamlined path to a funded trading account. To qualify, traders must meet the profit target, adhere to the trailing drawdown, limit their positions, and close all trades one minute before market close. The evaluation requires a minimum of 5 trading days, and the drawdown follows the highest unrealized profit. Traders can’t hold positions overnight, and going over the allowed positions results in disqualification. Upon meeting all requirements, traders are assigned an Elite account within 72 hours, allowing them to earn real money.

- Suitable for fast and frequent traders

- Trailing Drawdown

- Minimum of 5 days required

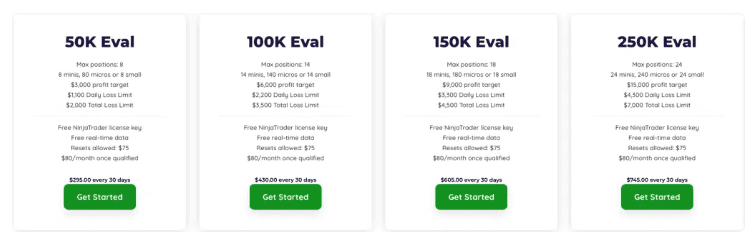

End of Day (EOD) Drawdown Evaluation

The End of Day Drawdown Evaluation from Elite Trader Funding is designed for disciplined traders who can manage risk within specific parameters. To qualify, traders must reach a profit target without breaching the end-of-day trailing drawdown or daily loss limit, and they must close all trades one minute before the market closes. The drawdown is based on the highest end-of-day balance, with a daily loss limit set by the previous day’s balance. A minimum of 5 trading days is required, with Sundays and Mondays counting as a single trading day. Exceeding the maximum allowed open positions or holding trades overnight results in disqualification. Once all criteria are met, traders receive a simulated Elite-funded account within 72 hours, allowing them to start earning real money.

- End of day drawdown calculation

- Account sizes: $50,000 – $250,000

- Resets allowed ($75)

- No scaling rule

- Daily loss: 1.7% – 2.2%

- Trailing drawdown: 2.8% – 6%

- Profit target: 6% – 7%

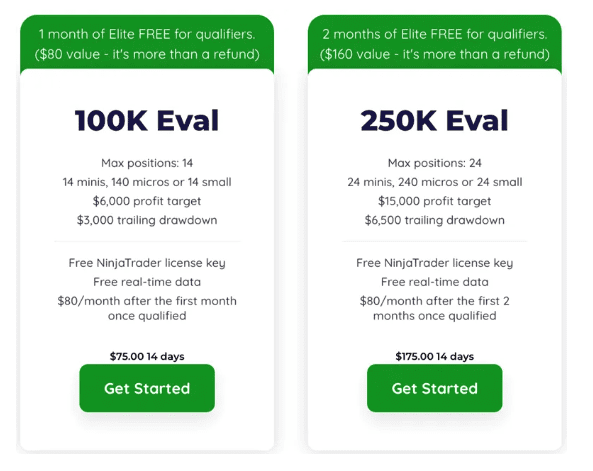

Fast Track Evaluation

The Fast Track Evaluation from Elite Trader Funding is ideal for traders seeking a quicker path to funding. To qualify, traders must complete at least 5 trading days and reach the profit target within a maximum of 14 calendar days, while adhering to the trailing drawdown and position limits. All trades must be closed one minute before market close, and overnight holding is not permitted. If the profit target isn’t met within 14 days but there’s a positive balance, traders can transfer to a 1 Step Evaluation. Meeting these criteria grants access to an Elite-funded account within 72 hours, paving the way for real earnings.

- Account sizes: $100,000 – $250,000

- Trailing Drawdown

- Minimum of 5 days required

- Maximum 14 calendar days to complete

- No scaling rule

- No resets allowed

- Trailing drawdown: 2.6% – 3%

- Profit target: 6% – 8%

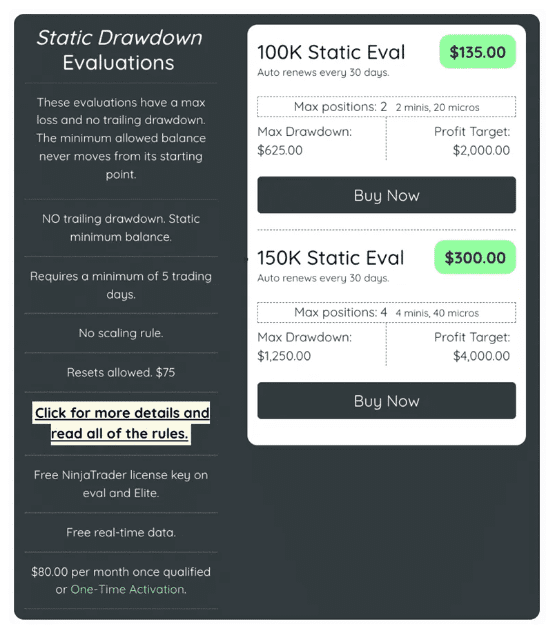

Static Drawdown Evaluation

The Static Drawdown Account from Elite Trader Funding offers a non-trailing, fixed drawdown option ideal for traders who prefer stable risk parameters. Traders are required to complete a minimum of 5 trading days and can opt for account resets at $75 if needed. Account sizes range from $100,000 to $150,000, with a maximum drawdown fixed at 0.6% to 0.8% of the starting balance. The profit target varies between 1.3% and 2.6%, providing achievable goals with a fixed risk structure.

-

- No trailing drawdown

- Minimum 5 days required

- Resets allowed ($75)

- Account sizes: $100,000 – $150,000

- Fixed maximum drawdown (0.6% – 0.8% of initial balance)

- Profit target: 1.3% – 2.6%

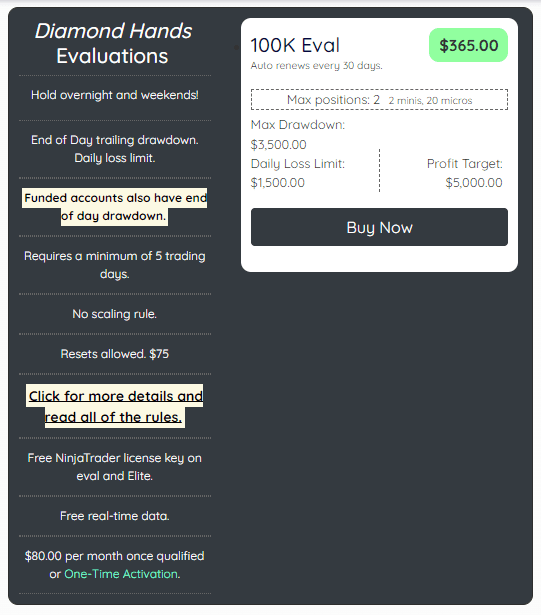

Diamond Hands Evaluation

- End of day drawdown calculation

- Hold positions overnight and weekends

- Minimum 5 trading days

- No scaling rule

- $100,000 account only

- Designed for swing traders

- Daily loss limit: 1.5%

- End-of-day trailing drawdown: 3.5%

- Profit target: 5%

Evaluation Rules

To pass and qualify for an Elite Sim-Funded account, traders must:

- Trade a minimum of 5 days (not necessarily consecutive)

- Meet the profit target

- Close all open positions 1 minute before market close (except for Diamond Hands)

- Not hit or exceed the intraday trailing drawdown (for 1 Step and Fast Track)

- Not hit or exceed the static daily loss limit and end of day drawdown (for EOD and Diamond Hands)

- Not hit or exceed the minimum static balance (for Static evaluations)

- Complete CME Rules and Regulations lessons

Additional rules for Fast Track:

- Must meet profit target and minimum trading days in 14 calendar days

Payout Structure and Process

Profit Split

- First $12,500: 100% to the trader

- After $12,500: 90% to the trader

Payout Requirements

- Safety Net: Earn profits equal to max drawdown + $100

- Active Trading Days: Complete required number of active trade days

- 40% Consistency Rule (for accounts purchased before August 1, 2024)

Payout Cycles

- 1st Payout Cycle: $100 – $2,000 (varies by account size)

- 2nd Payout Cycle: $100 – $2,250 (varies by account size)

- 3rd Payout Cycle: $100 – $2,500 (varies by account size)

- 4th+ Payout Cycle: No Min/Max

Active Trading Days

- Minimum $200 realized profit/day ($100 for some accounts)

- P&L must equal 23% of best trading day P&L

- Complete 10 active trade days for all payout cycles (for new evaluations purchased on or after October 1, 2024)

Payout Process

- Meet requirements

- Request payout (trade activity audited, KYC, Rise onboarding)

- Payout requests processed daily Monday through Friday, beginning at 3 PM Eastern

- Elite Sim payouts processed on Wednesdays

- Live Elite payouts processed daily

Pros & Cons

What we like:

Elite Trader Funding offers a variety of evaluation types to accommodate different trading styles, ensuring a customized experience for each trader. Moreover, the platform provides flexible trading hours with no restrictions during news events, allowing traders to capitalize on market volatility. In addition, the profit-sharing model is especially appealing, granting 100% of the first $12,500 in profits before shifting to an 80/20 split. Even better, traders benefit from a free monthly account reset if they do not pass the evaluation. On top of that, a 14-day free trial is available, giving traders a risk-free way to test the platform. Additionally, users can manage up to 20 accounts with a single login for greater flexibility and ease. Finally, the evaluation process is clear and transparent, helping build confidence from the very beginning.

Elite Trader Funding is tailored specifically for futures traders, with a strong emphasis on risk management. To start, the platform enforces strict daily loss limits and maximum drawdown rules to protect both traders and funds. Additionally, traders must meet predefined profit targets and complete a minimum number of trading days to qualify for funding. Once funded, there is an $80 monthly maintenance fee, covering account access and support. Overall, these structured rules create a disciplined trading environment focused on long-term success.

Unique Features

- Optional $75 evaluation reset

- Automatic free reset for failed evaluation upon subscription renewal.

- Free resets do not apply to Elite accounts

- NO restriction on news trading

- Ability to manage up to 20 funded accounts with a single login

- No restrictions on news trading

- Diamond Hands account for swing traders overnight and weekends

- One day to pass add on

Trading Platforms

- Free NinjaTrader license

- Compatible with Tradovate, TradingView, and Rithmic

- Free real-time data

Customer Support and User Experience

- Email support and comprehensive FAQ section

- Intuitive platform design

- Real-time account monitoring and performance tracking

- Educational resources (webinars, articles, videos)

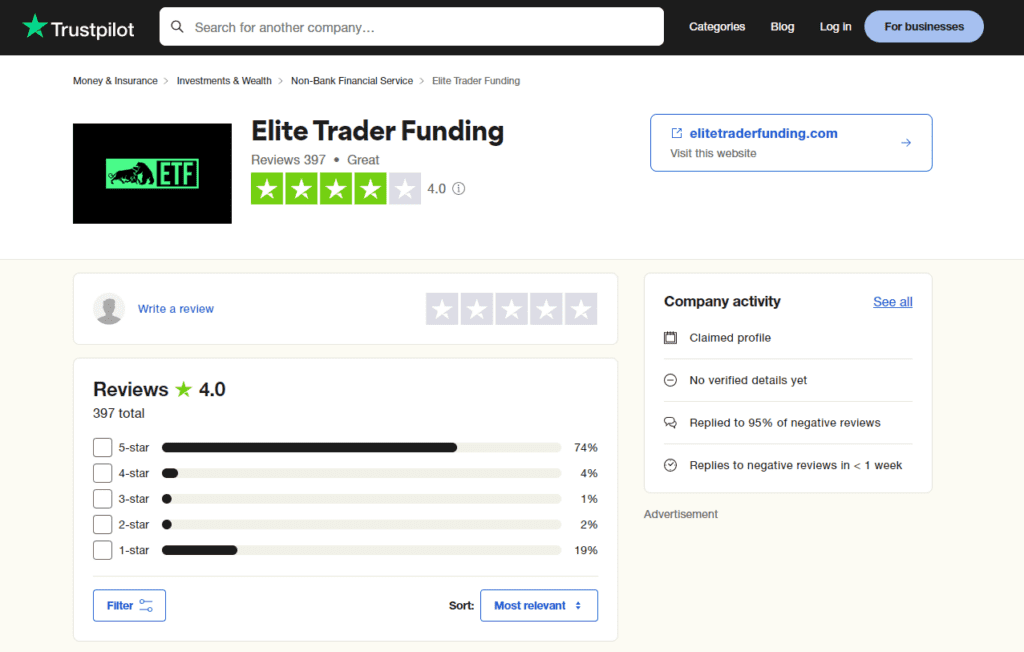

Elite Trader Funding Trustpilot Review Analysis

Overall Statistics:

- Totalreviews analyzed: 317

- Average rating: 4.45 out of 5 stars

- 5-star reviews: 80.4%

- 4-starreviews: 4.7%

- 3-starreviews: 2.5%

- 2-starreviews: 1.3%

- 1-starreviews: 11.0%

Key Themes

Customer Service (mentioned in 47% of reviews)

- Generally positive feedback

- Fast response times

- Helpful and knowledgeable staff

- Available through email and Discord

Trading Platform and Integration (mentioned in 35% of reviews)

- Integration with popular platforms like TradingView and Tradovate

- Some reports of technical issues or glitches

- Appreciation for multiple platform options

Evaluation and Funding Process (mentioned in 32% of reviews)

- Clear and straightforward rules

- One-step evaluation process appreciated

- Some concerns about changes in rules between evaluation and funded accounts

Payout System (mentioned in 28% of reviews)

- Mixed feedback on payout speed and process

- Sometraders report fast payouts, others mention delays

- Concerns about restrictions on withdrawal amounts in the first few months

Account Options and Flexibility (mentioned in 25% of reviews)

- Appreciation for various account types (e.g., static accounts, EOD accounts)

- Multiple concurrent accounts allowed

Pricing and Promotions (mentioned in 20% of reviews)

- Competitive pricing for evaluations

- Frequent promotions and discounts appreciated

Transparency (mentioned in 15% of reviews)

- Mixed opinions on transparency of rules and processes

- Some complaints about hidden fees or unclear terms

Summary of Elite Trader Funding Trustpilot Reviews

Elite Trader Funding offers a range of account types to suit traders at every level, from Evaluation accounts in multiple sizes to Elite accounts following a successful evaluation, and ultimately Live Elite accounts after a brief risk assessment period. Evaluations require a minimum of 5 trading days, with an end-of-day (EOD) drawdown option available. Once funded, accounts feature a trailing drawdown, with various platform options such as Tradovate, NinjaTrader, and TradingView. Payouts are available after 20 trading days, with initial withdrawal restrictions and processing times ranging from same-day to one week. Account resets are possible, though fees may apply. Customer support is available via email with fast response times, along with an active Discord community for added support.

Conclusion

Elite Trader Funding offers an attractive proposition for futures traders with its flexible evaluation options and generous profit-sharing structure. The firm’s multiple account types cater to various trading styles, from fast-paced day trading to longer-term swing strategies. The ability to manage multiple funded accounts through a single login is a significant advantage for experienced traders.

The company’s commitment to transparency, evidenced by its clear evaluation process and risk disclosure, is commendable. The free monthly account reset and 14-day trial period demonstrate a trader-friendly approach.

However, prospective traders should be aware of the strict drawdown rules and daily loss limits, which may be challenging for less experienced traders. The $80 monthly fee for funded accounts is also a factor to consider.

Overall, Elite Trader Funding is best suited for disciplined futures traders who can navigate the firm’s rules and capitalize on its flexible trading environment. The platform offers a good balance of opportunity and risk management, making it a solid choice in the proprietary trading industry, particularly for those focused on futures trading. With their free trail, and lots of options available to their traders, we have placed them as #7 on our list of Top Prop Firms of 2025.

Key Takeaways

- The daily loss limit and maximum drawdown rules make things more difficult

- Trading is limited to futures contracts

- 20 Trading days required to request payout

- Multiple Evaluation choices to accommodate various trading styles

- Flexible trading enviroment without restrictions on trading hours

- 100% profit split to the first $12,500, then 80/20 split.

- Your account will reset for free each month if you fail the evaluation

- 14 day free trial available

- Ability to trade up to 20 accounts with a trade copier

Elite Trader Funding Current Discounts/Coupon Codes

| Coupon | Product(s) | Discount |

|---|---|---|

| TopProp | Static Evaluations | 80% |

| TopProp | End of Day Evaluations | 80% |

| TopProp | Diamond Hands Accounts | 80% |

| TopProp | 1 Step Accounts | 90% |

Restricted Countries

Afghanistan, Albania, Algeria, Angola, Bahamas, Bangladesh, Barbados, Belarus, Belgium, Bosnia and Herzegovina, Botswana, Bulgaria, Burma, Burundi, Cambodia, Central African Republic, Congo Free State, Côte D’Ivoire, Crimea, Croatia, Cuba, Democratic Republic of Congo, Ecuador, Ethiopia, Ghana, Guyana, Iceland, Indonesia, Iran, Iraq, Jamaica, Kosovo, Laos, Lebanon, Liberia, Libya, Mauritius, Mongolia, Montenegro, Nicaragua, North Korea, North Macedonia, Pakistan, Panama, Papua New Guinea, Peru, Russia, Serbia, Slovenia, Somalia, South Sudan, Sri Lanka, Sudan, Syria, Trinidad and Tobago, Tunisia, Uganda, Ukraine, Venezuela, Vietnam, Yemen, Zimbabwe

Elite Trader Funding Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Purdia Capital | 1.74 | 5.68 | Varies | 7.12 | Varies | 6.12 | 14.92/6.04 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools 2026

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!