Purida Capital Review 2026

See the most recent Purdia Capital Trading sales and promotions below

In the ever-evolving landscape of proprietary trading firms, Purdia Capital has distinguished itself through its innovative approach to trader development and unique pathway to direct funding. Unlike traditional prop firms that focus solely on evaluation challenges, Purdia Capital offers multiple routes to funded trading, including their attractive direct-to-funded program that allows experienced traders to bypass traditional evaluation phases.

At its core, Purdia Capital’s philosophy centers on sustainable trading practices and long-term trader success. Their program structure reflects this commitment, offering both traditional evaluation paths for developing traders and accelerated direct to funded options for proven professionals. This dual approach sets them apart in an industry often criticized for its one-size-fits-all evaluation model.

The direct-to-funded program, in particular, represents Purdia’s understanding that experienced traders need a different path. This program allows qualified traders to begin with a simulated funded account immediately, avoiding the typical evaluation hurdles while still maintaining proper risk management standards. It’s a testament to Purdia’s commitment to meeting traders where they are in their professional journey.

This comprehensive guide will dive deep into every aspect of Purdia Capital’s offerings, from their traditional evaluation criteria to their innovative direct funding opportunities. We’ll explore their risk management framework, platform capabilities, market access, and profit-sharing structures. Whether you’re a developing trader looking to grow through their evaluation process or an experienced professional seeking immediate funding, understanding Purdia’s complete ecosystem will help you make an informed decision about your trading journey.

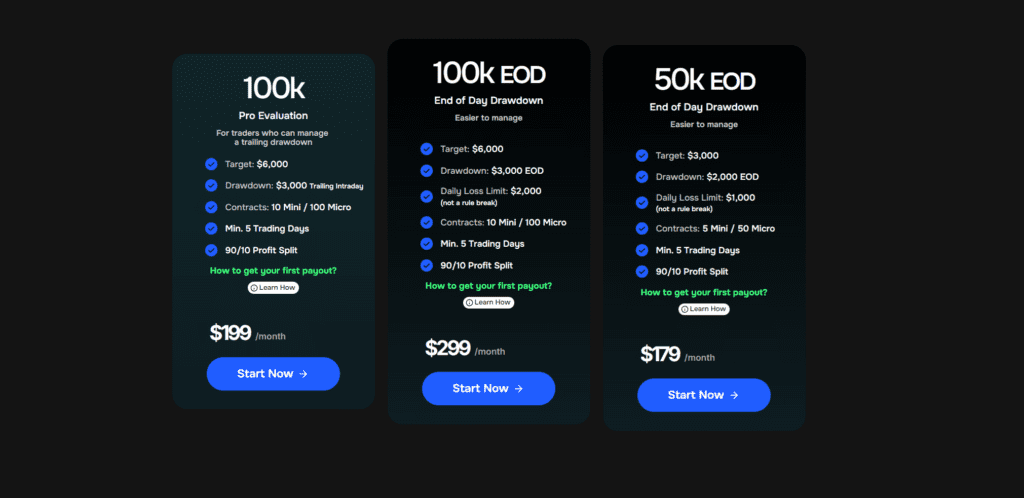

Purdia Capital Account Types And Options:

1. Evaluation Programs

These are monthly subscription-based accounts designed for traders who want to prove their profitability before moving to a funded account.

Key Features (All Evaluation Accounts): 5 minimum trading days, 90/10 profit split, and no consistency rules.

Note: The EOD (End of Day) drawdown is generally considered easier to manage than trailing intraday drawdown because it only updates at the close of the trading day.

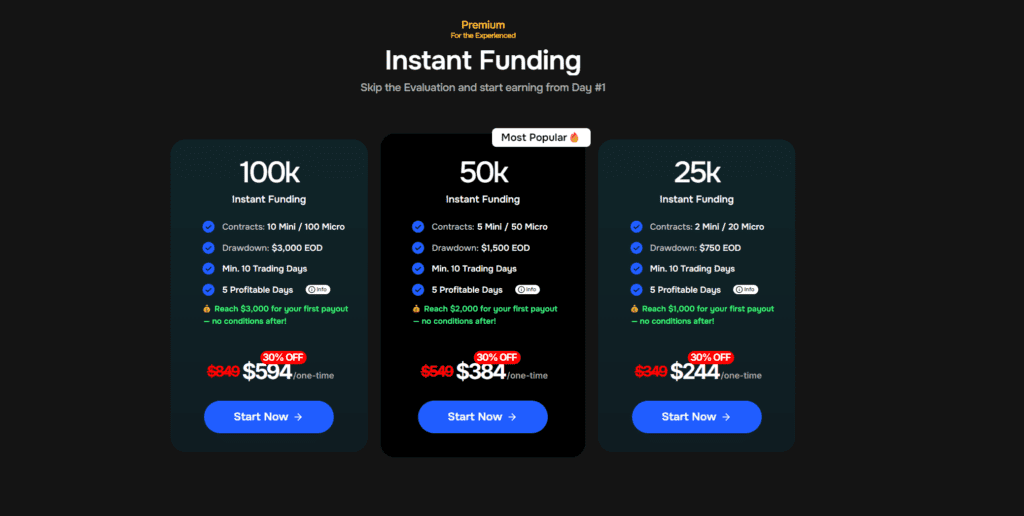

2. Instant Funding (Experienced Traders)

These accounts allow you to skip the evaluation phase. You pay a one-time fee and can start earning from Day 1.

Key Features: End of Day (EOD) drawdown, 10 minimum trading days required for the first payout, and 5 profitable days required.

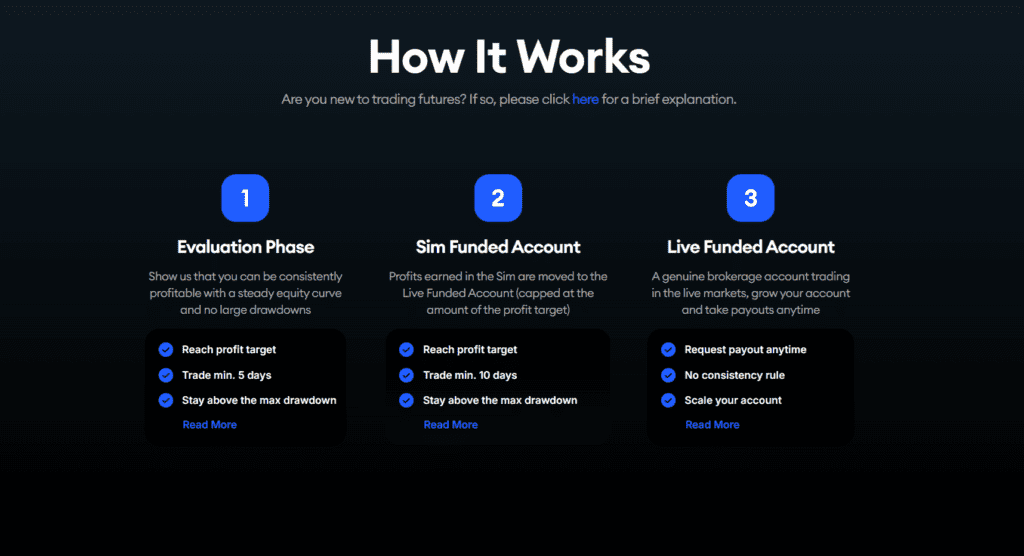

Evaluation Program Roadmap

The evaluation programs at Purdia Capital is designed to identify traders who can consistently perform while managing risk effectively. This phase sets the foundation for long-term success in the program.

Trading Schedule:

- Minimum five trading days

- No overnight positions

- Trading hours: Market open until 3:45 PM CT

- Resume trading at 5:00 PM CT

Performance Metrics:

- Meet specified profit target

- Maintain consistency requirements

- Stay within maximum drawdown limits

- Follow position size restrictions

Risk Management:

- Adhere to daily loss limits (if applicable)

- Monitor trailing drawdown

- Maintain proper position sizing

- Practice disciplined trade management

Reset Options

Standard Reset:

- $65 fee

- Immediate account restart

- Maintain existing subscription

- Reset all metrics

Subscription Renewal Reset:

- Free reset with renewal

- Fresh starting balance

- Reset all parameters

- New evaluation period

Supported Platforms

Tradovate:

Web-based platform

Mobile trading capability

Integrated charting

Real-time market data

NinjaTrader:

Advanced charting

Custom indicators

Automated trading capability

Professional-grade tools

TradingView:

Popular charting platform

Social trading features

Multiple timeframe analysis

Custom indicator support

Available Markets

Currencies:

16 major forex futures

Full range of micro contracts

Major currency pairs

High liquidity options

Indices:

Major US indices

International markets

Micro and mini contracts

High volume products

Commodities:

Energy products

Precious metals

Agricultural futures

Various contract sizes

Profit and Payout Structure

Initial Terms:

70/30 base split (trader/firm)

Potential increase to 90/10

Performance-based improvements

Regular review periods

Pro Account Split:

90/10 split from start

Higher initial requirements

Enhanced earning potential

Professional trading expectations

Payout Rules:

Minimum withdrawal: $100

No maximum cap

24-hour processing

Multiple payment methods

Payout Options:

ACH transfers

PayPal payments

International wire transfers

Regular withdrawal schedule available

Risk Management Framework

Purdia Capital’s risk management system combines technological safeguards with human oversight to create a comprehensive protection framework. This multi-layered approach helps traders develop disciplined habits while protecting capital.

Daily Loss Limit:

Maximum 33% of available drawdown

Daily reset schedule

Customizable thresholds

Automated enforcement

Implementation:

Optional during evaluation

Required for funded accounts

Platform-integrated monitoring

Real-time tracking available

Drawdown Management Evaluation Phase

Trailing drawdown system

Updates with new equity highs

Intraday or end of day tracking

No reduction with losses

Live Account:

Static drawdown at breakeven +$100

Fixed protection level

Clear violation parameters

Straightforward monitoring

Risk Monitoring Tools & Platform Integration:

Real-time balance tracking

Drawdown distance indicators

Position size monitors

Risk exposure calculations

Reporting Requirements:

Daily performance updates

Regular risk manager meetings

Position justification when requested

Trading plan adherence

Growth and Scaling Opportunities

Performance Based Scaling Requirements:

Consistent profitability

Strong risk management

Proven trading discipline

Regular communication maintenance

Benefits:

Increased position sizes

Higher profit potential

Enhanced trading flexibility

Professional development support

Communication Requirements

Regular Check-ins:

Weekly risk manager meetings

Performance reviews

Strategy discussions

Plan adjustments

Reporting:

Daily trading summaries

Performance metrics

Risk management adherence

Strategy implementation updates

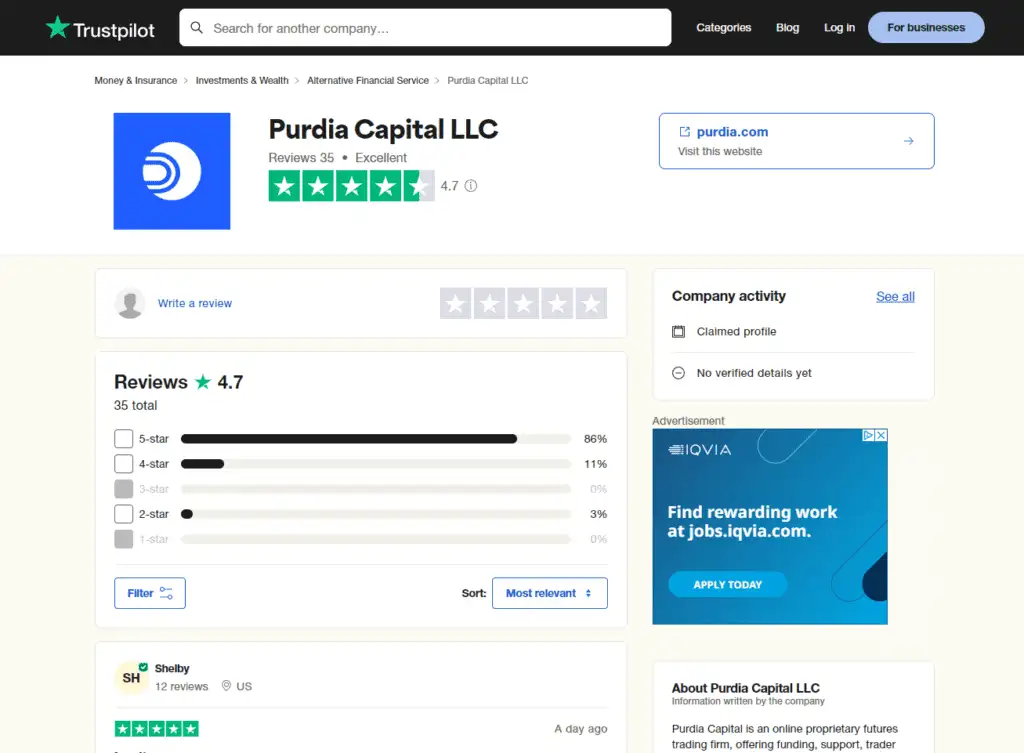

Purdia Capital TrustPilot Review Aggregation

Purdia Capital Trustpilot Review Summary Statistics

Overall Rating: 4.7/5 stars

Total Reviews: 35

Rating Distribution:

5-star: 86%

4-star: 11%

3-star: 0%

2-star: 3%

1-star: 0%

Key Purdia Capital Trustpilot Key Themes Mentioned

Personalized Support & Management (Mentioned in ~40% of reviews)

One-on-one video calls with CEO Jonas and risk managers

Weekly checkups and coaching sessions

Personalized risk management guidance

Responsive customer service

Direct access to support staff

Trading Conditions (Mentioned in ~35% of reviews)

Daily loss limits without account forfeiture

Trading hours until 3:45 CT

Daily payouts available

90/10 profit split

Firm pays for live data feeds

Real live trading accounts (not simulated)

Evaluation Process (Mentioned in ~25% of reviews)

Two-step evaluation process

Straight-to-funded options available

Some mention of higher evaluation costs compared to competitors

Clear rules and guidelines

Educational Support (Mentioned in ~20% of reviews)

Focus on trader development

Trading psychology guidance

Risk management education

Long-term trader development approach

Notable Positive Aspects:

- Flexibility in trading strategies allowed

- No complicated restrictions

- Transparent communication

- Focus on trader success rather than fees

- Quick payout processing

- Real live accounts versus simulation

- 22.1% of reviews highlight that BluSky offers real live trading accounts

- 15.2% appreciate the transition from evaluation to live trading

- 8.3% mention the discord live trading room and education

Recent Developments (2025 Reviews)

Improved trading hours (extended to 3:45 CT from 3:00 CT)

Increased focus on personalized support

Multiple mentions of successful payouts

Growing reputation in the prop firm space

Customer Experience

- Over 90% of reviewers report positive experiences

- Multiple reviews mention long-term commitment to the firm

- Strong emphasis on the company’s commitment to trader success

- High satisfaction with support staff, particularly CEO Jonas and team member Andrew

This analysis shows Purdia Capital positions itself as a more personalized, trader-focused prop firm that prioritizes long-term trader development over quick evaluations. Their approach is more hands-on compared to traditional prop firms, some traders may like this, others will not. They have a strong emphasis on support and education for their traders.

Key Takeaways

- Higher upfront cost than others

- Direct to funded option

- End of day drawdown

- Direct Communication with Team

- Semi Automated Trading OK

- Fast payouts

- Company management active online

- Excellent live chat customer support

- Multiple account options

- Excellent trader reviews

- Direct path to live funding

Conclusion on Purdia Capital

Purdia Capital offers a highly structured and professional approach to funded trading, with a clear focus on sustainable growth and risk management. Thier direct to funded option is ideal for traders who have demonstrated their ability to perform and want to skip the evaluation. Success in their program, and any trading in general requires dedication to both trading excellence and professional development. This is not designed for gamblers. Understanding and utilizing all aspects of Purida’s program, from technical tools to support resources, will help maximize your potential for success.

Purdia Capital Current Discounts/Coupon Codes

| Coupon | Product(s) | Discount |

|---|---|---|

| propplus | All accounts | 30% Off |

Purdia Capital Restricted Countries

Afghanistan, Albania, Antarctica, Barbados, Belarus, Bosnia and Herzegovina, Bulgaria, Burkina Faso, Cameroon, Congo, Croatia, Cuba, Ethiopia, Gibraltar, Haiti, Hong Kong, Iran, Iraq, Jamaica, Jordan, Kenya, Korea (Democratic People’s Republic of), Kosovo, Lebanon, Libyan Arab Jamahiriya, Mali, Mauritius, Monaco, Montenegro, Morocco, Mozambique, Myanmar, Namibia, Nigeria, Pakistan, Philippines, Qatar, Romania, Russian Federation, Senegal, Serbia, Slovenia, Somalia, South Africa, Sudan, Syrian Arab Republic, Tanzania, Turkey, Turkmenistan, Uganda, United Arab Emirates, Venezuela, Vietnam, Yemen, Zimbabwe

Purdia Capital Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Purdia Capital | 1.74 | 5.68 | Varies | 7.12 | Varies | 6.12 | 14.92/6.04 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools 2026

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!