BluSky Trading Company Review 2026

See the most recent BluSky Trading sales and promotions below

In the crowded space of funded trading programs, BluSky Trading has emerged as a notable player with some distinct characteristics that set it apart from traditional prop firms. This comprehensive guide aims to provide new traders with an unbiased, detailed look at what BluSky Trading offers, how it works, and what you should know before committing your time and money.

With a documented pass rate of 16.9% (April-November 2023), BluSky is transparent about the challenge ahead – this isn’t a program where everyone succeeds. However, what makes BluSky interesting is their approach to trader development, particularly their unique BluLive phase that bridges the gap between evaluation and funded trading. While other firms might rush traders into funded accounts, BluSky’s structure suggests a focus on sustainable trading development.

This guide will walk you through everything you need to know about trading with BluSky, from getting started to making your first withdrawl.

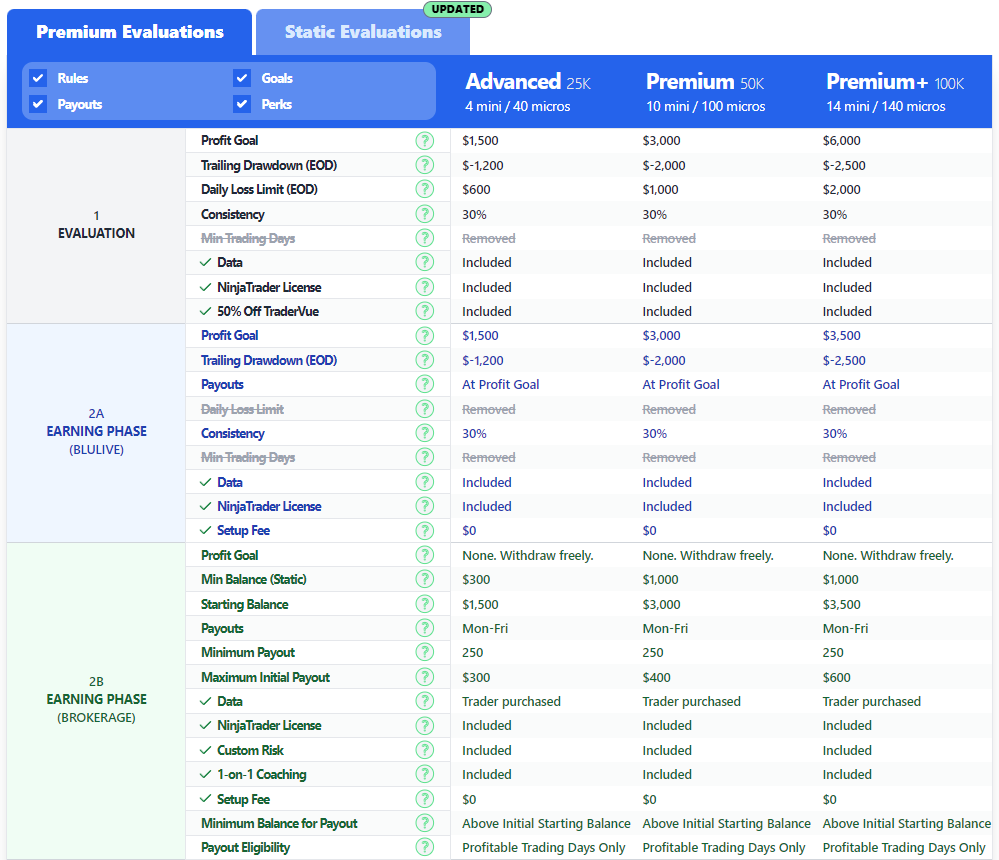

BluSky offers two account types:

1. Premium End of Day Drawdown

2. Static Evaluations

The key difference is the end of day drawdown (your loss limit) follows your account balance up, and the static drawdown keeps the liquidation threshold at the same balance.

Both account types offer different account size options:

Premium End of Day Evaluations: $25K, $50K, $100K

Static Accounts: $150K & $200K

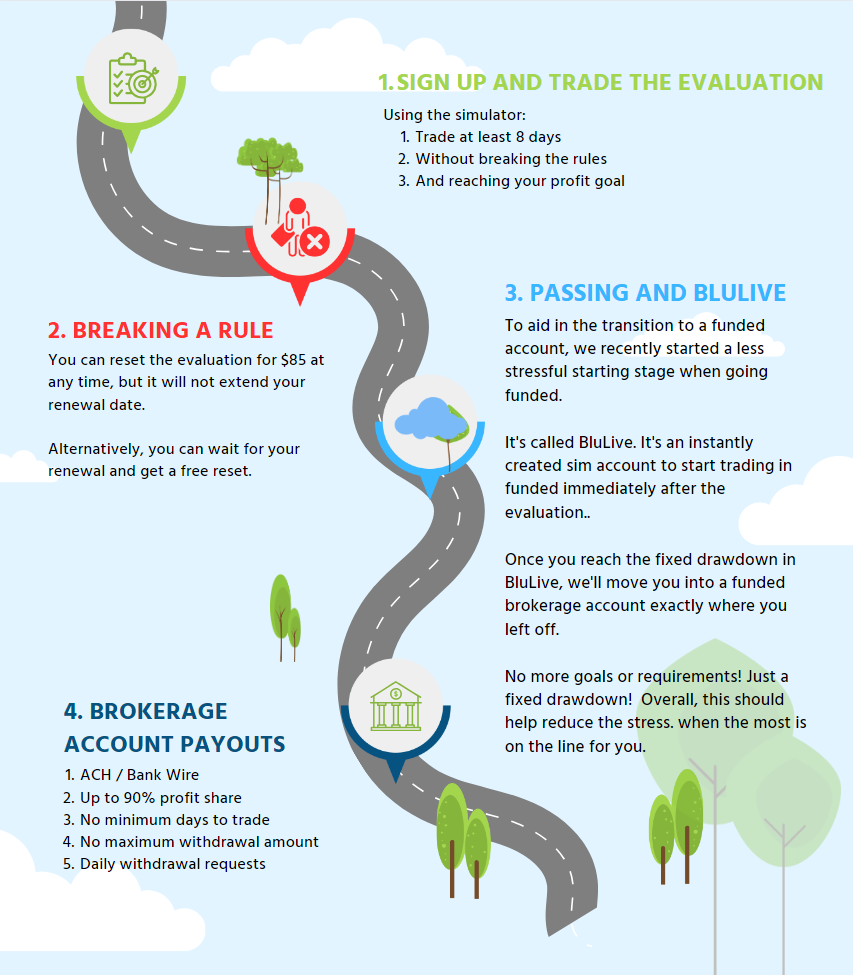

Account development is split into three phases:

1. Evaluation Phase

2A. Earning Phase (Blulive)

2B. Earning Phase (Brokerage)

BluSky Trading Premium End of Day Evaluations

BluSky Trading Static Accounts

Phase 1: The Evaluation

Key Rules:

Minimum 8 trading days

30-day evaluation period

Must maintain 30% consistency

Must reach profit target

Must stay above minimum trailing balance

If You Break a Rule:

Reset fee: $65

Free reset with subscription renewal

Phase 2A: BluLive

Until you reach your static drawdown, you’ll be in a sim account.

The simulated profits accrued in BluLive will be matched in your funded balance. There is a max amount set per account type. Stop trading when you reach this target.

This is not an evaluation step. This is a way to help trader’s transition forward with less stress, delay increased data costs, and help reduce company’s risk at the same time.

The consistency rule in place to help you train your mindset and succeed in brokerage.

Only one rule remains:

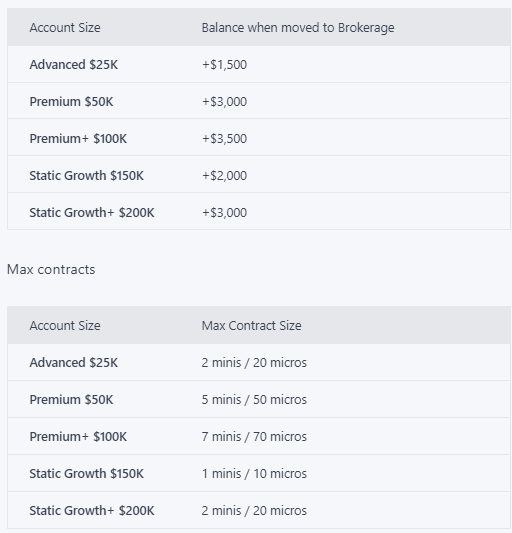

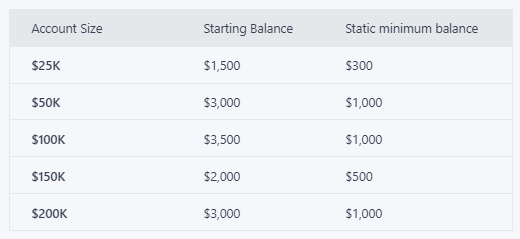

Premium accounts:

The trailing drawdown that becomes static once your reach the balance indicated in the table below.

Static Growth account:

Keep the balance over $149,200

Static Growth+ account:

Keep the balance over $198,000

So this means you start building funds that will be transferred to your brokerage account. There is no daily loss limit.

Also, quicker account creation. They no longer need to coordinate with the brokerage right after the evaluation, enabling faster setup.

Reduced initial risk for our company so we can reduce rules and increase trader resources in the long term.

Once you’ve reached the targeted balance in BluLive:

You will transition you to a funded brokerage account. This account will have a static drawdown and allow for withdrawals, as indicated by the specified amount below.

Do not continue to trade over the target balance below. Have all positions closed.

Excess earnings will not be transferred to your brokerage account.

Phase 2B: Funded Account

Note: Blusky no longer charge any setup fees for moving into the brokerage account.

Once you reach the required balance in BluLive, we’ll move you into the brokerage account.

You will start the brokerage account with the simulated balance from BluLive with a static dradown and withdrawls enabled.

Payouts

Minimum withdrawal: $250

Process before 12PM ET for same-day processing

1-3 business days for transfer

Paid through Gusto.com

No minimum trading days required

BluSky Trading Company Additional Rules

Maximum 3 concurrent evaluation accounts

Maximum 2 Funded brokerage accounts

Trade copier allowed

At least one trade per month

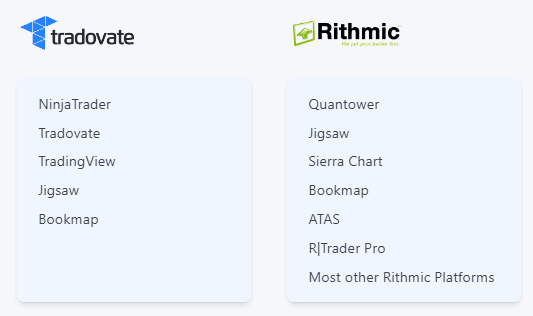

Blusky Trading Platforms

News Trading Policy

- No specific news trading rules

Prohibited Practices

No opposing positions in same product

Account Maintenance

- Must place at least one trade per month to keep account active

- Option to reset Starter Sim Funded accounts (maximum of three resets per account)

Automated Trading

- Fully automated trading and scalping systems are not prohibited in their rules.

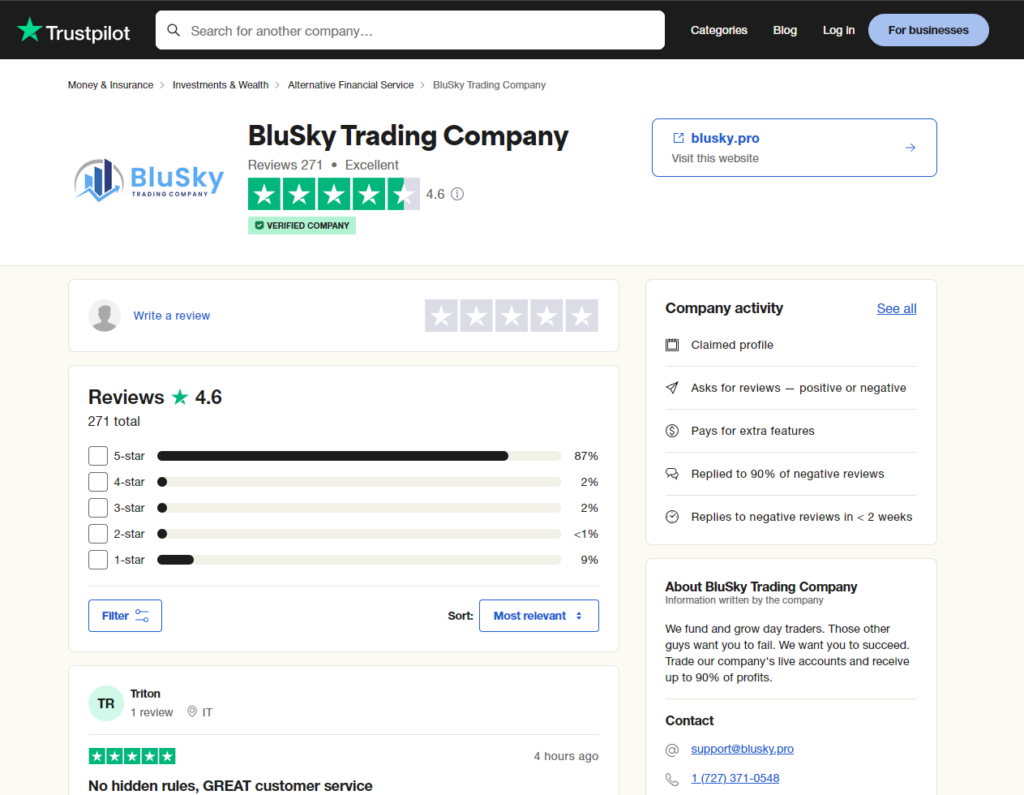

BluSky Trading TrustPilot Review Aggregation

BluSky Trading Trustpilot Review Summary Statistics

- Total reviews analyzed: 217

- Average rating: 4.54 out of 5 stars

- 5 stars: 186 reviews (85.7%)

- 4 stars: 7 reviews (3.2%)

- 3 stars: 3 reviews (1.4%)

- 1 star: 21 reviews (9.7%)

Key BluSky Trading Trustpilot Review Themes

Customer Support

- Positive support experiences: 48.4% of reviews praise customer support.

- Fast response times: 35.5% mention quick response times (often within minutes)

- Support quality: 25.3% specifically mention professional and knowledgeable support staff

Live Trading Features

- 22.1% of reviews highlight that BluSky offers real live trading accounts

- 15.2% appreciate the transition from evaluation to live trading

- 8.3% mention the discord live trading room and education

Payout Experience

- 18.4% mention successful payouts

- 12.4% specifically praise fast payout processing

- 5.5% report payout issues or denials

Trading Rules and Structure

- 20.3% praise clear and fair trading rules

- 15.2% mention the static account option positively

- 7.8% discuss drawdown rules (mixed feedback)

Platform and Technology

- 12.4% praise platform reliability

- 8.3% mention integration with various platforms (Tradovate, NinjaTrader)

- 5.1% report technical issues

Educational Resources

- 15.7% mention educational support and resources

- 10.6% specifically praise the daily live trading sessions

- 8.3% mention community support in Discord

Potential Concerns

- Some reports of technical issues

- A few complaints about rule changes

- Occasional payout delays or denials

- Higher evaluation costs compared to some competitors

Unique Features

- No activation fees

- Daily withdrawal options

- Real brokerage accounts

- Static account options

Recent Improvements

- Faster payout processing

- Enhanced customer support

- Platform stability improvements

- Clearer communication

Negative Themes (less frequent but notable)

The main criticisms center around technical issues, occasional payout delays, and some concerns about rule changes. However, the company appears responsive to trader feedback and actively works to improve their service. For potential traders, the higher evaluation costs may be offset by the absence of activation fees and the opportunity to trade real live accounts. The educational resources and support system make it particularly attractive for serious traders looking for a long-term prop firm relationship.

Key Takeaways

- Multistep funding process

- Higher upfront cost than others

- No activation fees

- End of day drawdown

- Static drawdown accounts

- Multiple account options

- Fast payouts

- Excellent customer support

- 90/10 profit split on brokerage accounts

- Excellent trader reviews

- Live trading room

- Active online community

Conclusion on BluSky Trading Company

In conclusion, BluSky Trading Company appears to be a well-regarded prop firm with particularly strong customer service and a focus on real live trading rather than simulated accounts. The high percentage of positive reviews (88.9% 4 or 5 stars) suggests general trader satisfaction. The company’s commitment to providing real brokerage accounts and educational support sets it apart from many competitors making BluSky Trading Company #3 on our list of Top 10 Prop Firms of 2025.

BluSky Trading Current Discounts/Coupon Codes

| Coupon | Product(s) | Discount |

|---|---|---|

| 30OFF | All Accounts | 30% |

BlueSky Trading Restricted Countries

Afghanistan, Åland Islands, Albania, Algeria, Angola, Antarctica, Bahamas, Barbados, Belarus, Bonaire, Bosnia and Herzegovina, Botswana, Burkina Faso, Burundi, Cameroon, Cayman Islands, Central African Republic, Congo, Croatia, Cuba, Curaçao, Ecuador, Ethiopia, Ghana, Gibraltar, Guyana, Haiti, Iceland, Indonesia, Iran, Iraq, Isle of Man, Ivory Coast (Côte d’Ivoire), Jamaica, Jersey, Jordan, North Korea, Lao PDR, Lebanon, Liberia, Libya, Libyan Arab Jamahiriya, Macedonia, Madagascar, Mali, Malta, Mauritius, Mongolia, Montenegro, Morocco, Mozambique, Myanmar (Burma), Nauru, Nicaragua, Nigeria, Pakistan, Palestine, Panama, Papua New Guinea, Philippines, Republic of North Macedonia, Romania, Russia, Russian Federation, Saint Barthélemy, Saint Martin (French part), Sao Tome and Principe, Senegal, Serbia, Sint Maarten (Dutch part), Slovenia, Somalia, South Africa, South Sudan, Sri Lanka, Sudan, Sudan/Darfur, Syria, Syrian Arab Republic, Tanzania, Timor-Leste, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Uganda, United Arab Emirates, Venezuela, Vietnam, Yemen, Yugoslavia, Zimbabwe.

BluSky Trading Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Purdia Capital | 1.74 | 5.68 | Varies | 7.12 | Varies | 6.12 | 14.92/6.04 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools 2026

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!