TradeDay Review & Discounts 2026

See the most recent sales and promotions for TradeDay below

TradeDay is a futures proprietary trading firm founded in 2020 by Steve Miley. Based in Chicago, it offers a comprehensive platform for trader education, mentoring, and funding. TradeDay aims to support aspiring traders by providing them with the tools, knowledge, and capital needed to succeed in the futures market.

TRADEDAY FEATURES

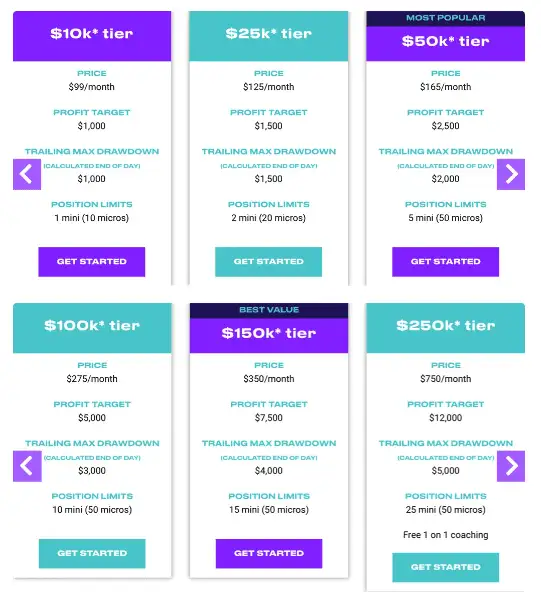

Instruments: Futures trading (specific instruments not detailed) Max balance: Up to $250,000 (scaling plan available) Profit split: 100% of first $10,000, then 90/10 split (trader/firm)

Evaluation cost: Varies by program Platforms: Tradovate (primary), with support for NinjaTrader, TradingView, and Jigsaw

PROS AND CONS

What we like:

- Comprehensive education and mentoring programs

- One-stage evaluation process

- Free access to Tradovate platform and CQG data feed

- No recurring fees after qualifying for funding

- Live funded account available immediately upon passing evaluation

- Withdrawals allowed from day one with no waiting period

- End-of-day drawdown calculation

What could be improved:

- Limited account options compared to some competitors

- No multiple account trading allowed

- Limited promotional offers

EVALUATION PROCESS

- One-stage evaluation

- Minimum 11 trading days required

- Profit target and drawdown limits (specific amounts not provided)

- Trailing drawdown stops at initial balance

- End-of-day drawdown calculation

ACCOUNT OPTIONS

- Two account sizes available (specific amounts not provided)

- Scaling plan: For every $2,000 in profit, traders get an extra contract

EDUCATIONAL RESOURCES

- Comprehensive trader development programs

- Daily pre-market meetings and live streams

- Community forum for peer support

- Individual coaching sessions (included in Advanced program)

- Performance coaching focused on trading psychology

TRADING PLATFORMS

- Tradovate (primary platform, provided free)

- Support for NinjaTrader, TradingView, and Jigsaw (trader’s own license required)

- CQG data feed

FUNDING AND PAYOUTS

- 100% profit split on first $10,000

- 90/10 split thereafter (trader/firm)

- Withdrawals allowed from day one

- Minimum withdrawal amount: $250

- No maximum withdrawal frequency

- Withdrawals typically processed within a week

UNIQUE FEATURES

- 14-day free trial available

- $139 one-off activation fee for funded accounts

- No recurring subscription fees after qualifying for funding

- Live funded account available immediately upon passing evaluation

TRADING RULES

- Same rules apply for evaluation and funded accounts

- Scaling plan must be adhered to

- No overnight holding of positions (day trading only)

- News trading restrictions may apply (details not provided)

CONCLUSION

TradeDay offers a compelling opportunity for aspiring futures traders, particularly those who value education and mentorship alongside funding. The firm’s one-stage evaluation process, immediate access to live funding, and flexible withdrawal policy are significant advantages. The comprehensive educational resources and community support can be particularly beneficial for traders looking to improve their skills.

However, traders should be aware of the limited account options and the restriction on multiple account trading. The platform choices, while adequate, may not be as extensive as some competitors offer.

Overall, TradeDay is best suited for traders who appreciate a holistic approach to prop trading, combining education, mentorship, and funding opportunities. It’s particularly attractive for those who prefer day trading futures and are looking for a supportive environment to develop their skills and potentially transition into professional trading. Making them #8 on our list of Top Prop Trading firms of 2025.

TRADEDAY CURRENT DISCOUNT / COUPON CODES

Coupon Product(s) Discount

PropPlus All evaluations 20%

TRADEDAY RESTRICTED COUNTRIES

Afghanistan, Côte d’Ivoire, Laos, Slovenia, Albania, Crimea, Lebanon, Somalia, Algeria, Croatia, Liberia, South Sudan, Angola, Cuba, Libya, Sri Lanka, Bahamas, Democratic Republic of Congo, Mauritius, Sudan, Barbados, Ecuador, Mongolia, Syria, Belarus, Ethiopia, Montenegro, Trinidad and Tobago, Bosnia and Herzegovina, Ghana, Nicaragua, Tunisia, Botswana, Iceland, North Korea, Turkey, Bulgaria, Indonesia, Pakistan, Uganda, Burma (Myanmar), Iran, Panama, Ukraine, Burundi, Iraq, Papua New Guinea, Vietnam, Cambodia, Jamaica, Russia, Venezuela, Central African Republic, Kosovo, Serbia, Yemen, and Zimbabwe.

As of October 8th 2024, the following countries are also restricted from purchasing: Burkina Faso, Kenya, Philippines, Cameroon, Macedonia, Qatar, China, Mali, Romania, Gibraltar, Mozambique, Senegal, Haiti, Myanmar, South Africa, Hong Kong, Namibia, Tanzania, Jordan, Nigeria, and United Arab Emirates.

TRADEDAY COMMISSION COMPARISON

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Purdia Capital | 1.74 | 5.68 | Varies | 7.12 | Varies | 6.12 | 14.92/6.04 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools 2026

Top Trading Tools 2026

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!