Apex Trader Funding Review & Discounts 2025

See the most recent Apex Trader Funding sales and promotions below

Apex Trader Funding is a pioneer in proprietary futures trading space, they emerged in 2021 under the leadership of Darrell Martin. The company offers an innovative approach that enables traders to access substantial capital without putting their personal funds at risk.

Apex initially captured market attention through its relaxed trading parameters and competitive pricing structure, the company has subsequently undergone several significant policy transformations as a direct response to its aggressive market entry. Indeed, while Apex consistently emphasizes the importance of steady trading practices, it has, somewhat ironically, demonstrated considerable fluidity in its own rules and expectations.

It’s crucial to understand that Apex specifically caters to methodical, disciplined traders. Therefore, if your strategy involves aggressive full-position trading or pursuing quick profits, you might want to explore alternative options. Furthermore, the company continues to evolve its operational framework and currently operates under what they’ve branded as their “Apex 3.0” model.

In light of these developments, our comprehensive analysis will delve deep into the Apex 3.0 system, which notably stands out in the industry for two key reasons: first, its remarkably competitive pricing structure, and second, its unique capability to accommodate traders managing up to 20 concurrent accounts.

Apex Trader Funding Account Types

At it’s core, Apex Trader Funding implements a carefully structured two-phase evaluation system. To begin with, traders must successfully complete an initial evaluation phase that effectively demonstrates their trading capabilities.

Once this crucial first step is accomplished, traders then advance to a simulated funded account, where consequently, they gain the valuable ability to withdraw their earned profits.

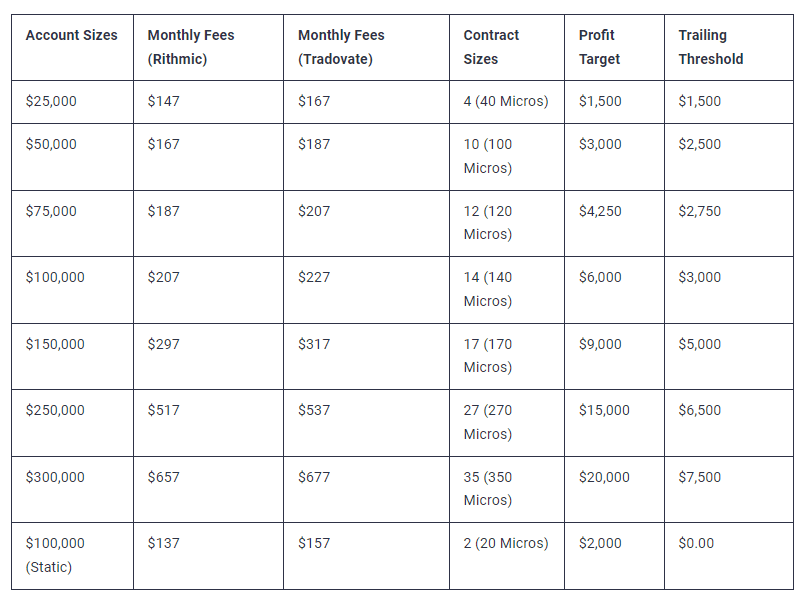

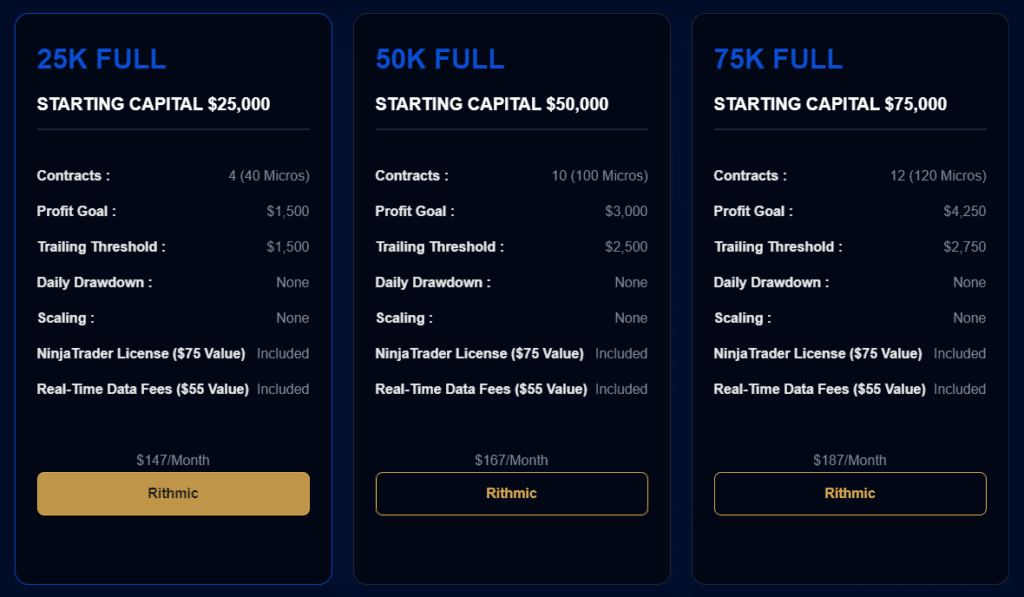

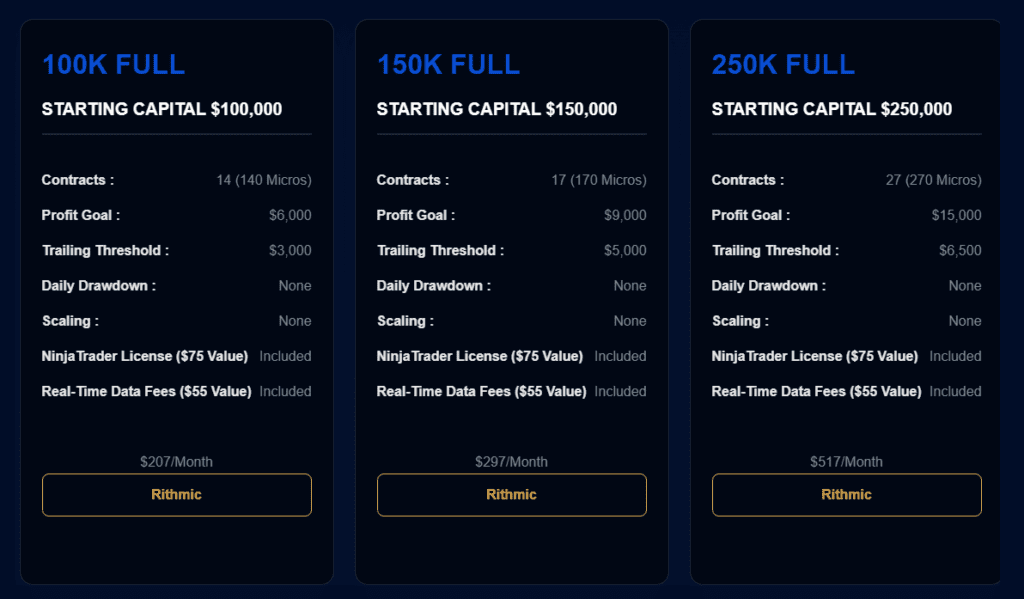

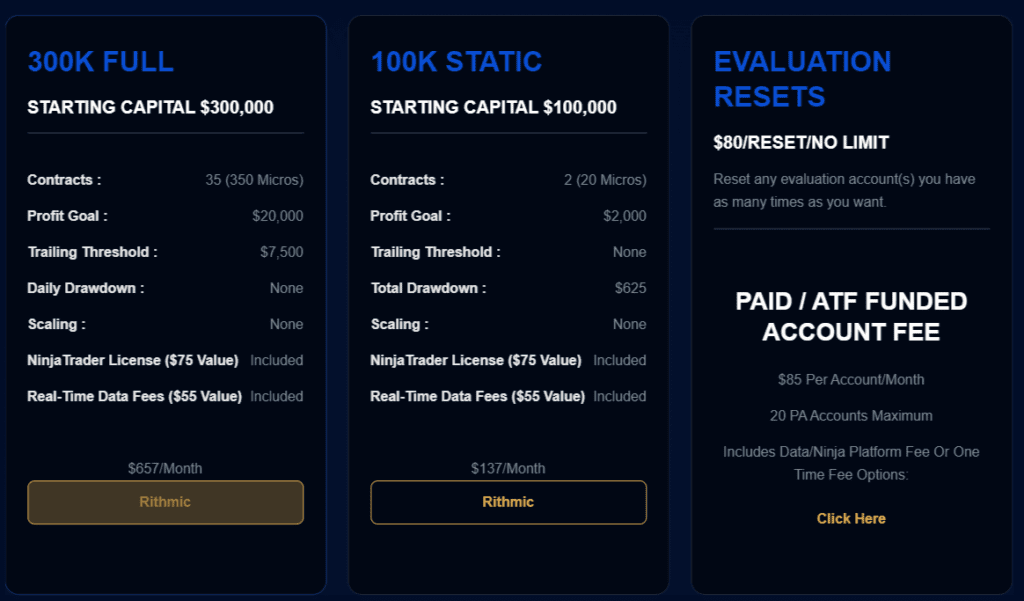

Apex currently offers a comprehensive selection of eight distinct account size options, which we will outline in detail below. Allowing a trader to trade up to 20 account using a trade copier at the same time.

The journey typically unfolds as follows: traders initially start with an evaluation account, and subsequently, upon meeting all necessary evaluation requirements, they can successfully transition into a performance account. Through this systematic progression, traders can methodically build their trading career while gaining access to increasingly substantial capital.

Apex Trader Funding Evaluation Accounts

Evaluation Process

Want to trade with Apex Trader Funding? Here’s how it works:

You only need to pass one test to get your funded account. Here are the rules:

- Make a certain amount of profit based on your account size

- Don’t lose more than allowed (they use a trailing stop loss)

- Take as much time as you need – there’s no deadline

Trade whenever you want – no minimum number of trading days required

Apex Trader Funding Evaluation Rules

When it comes to Apex’s evaluation phase, the rules are remarkably straightforward compared to the funded (PA) accounts and trader-friendly.

There is only one primary way to fail the evaluation: exceeding the trailing max drawdown threshold..

Unlike many other proprietary trading firms, Apex sets itself apart by not imposing any consistency rules during the evaluation period. You can pass on day one without any restrictions.

It’s crucial to note that all traders must adhere to one strict timing requirement: specifically, all trades and pending orders must be closed no later than 4:59 PM EST.

- The only way to fail is by hitting the trailing max drawdown threshold or

breaking other specified rules - No consistency rules for evaluation accounts

- All trades and pending orders must be closed by 4:59 PM EST (some markets

close earlier)

Resetting Evaluation Accounts

Need to restart your Apex trading test? Here’s what you need to know:

Reset Costs: (Sometimes there are sales on resets)

- Rithmic platform: $80

- Tradovate platform: $100

- Watch for sales – prices might be lower!

What happens when you reset:

- Your balance starts fresh

- Your loss limits start over

- Your trading days counter goes back to zero

- Your renewal/expiration date stays the same

Good news! You can get a free reset if:

- Your account fails before your monthly renewal date, on your monthly renewal date your account will be reset if failed.

This reset system helps you bounce back from setbacks.

- Costs $80 for Rithmic accounts and $100 for Tradovate accounts

- Resets balance, drawdown, and accumulated trading days

- Does not change the renewal/expiration date

- Free reset upon monthly auto-renewal if account is in failed status at market close prior to renewal

Apex Trader Funding Performance Accounts (PA)

Activation

Passed your Apex Trader Funding evaluation? Here’s what happens next:

Three simple steps:

- Wait for your confirmation email (comes within 2 business days)

- Sign your Performance Account paperwork

- Pay the $85 activation fee (might be less during sales)

That’s it! Apex keeps things quick and simple so you can start trading with real money sooner rather than later.

- Traders receive an email within two business days of passing the evaluation

- Must sign PA agreements and pay PA fee

- Pay activation fee currently $85, subject to change

Apex Trader Funding Trading Rules (PA Accounts)

Risk Protection:

- Your “safety net” (trailing drawdown) stops at your starting balance plus $100

- Once you’re in profit by your drawdown amount, your starting balance becomes your cutoff point

Important Daily Rules:

- Watch your open profit/loss carefully

- Stay within your contract limits for your account size

- Follow a clear trading strategy with specific rules

Flexible Features:

- Trade when you want – no required trading days

- Can trade during news times (with some limits)

- No penalties for taking breaks

Remember: The “safety net” is your protection line that moves up as you make profits. It’s different for each account type, so know your limits!

- Trailing threshold stops at the initial plan balance plus $100

- Traders cannot let their open P&L

- Trade up to maximum allowed contracts

- No inactivity rules or required number of trading days

- Can trade during news times (with restrictions)

- Must have a defined strategy or system with set rules

- “safetynet” is your trailing drawdown amount specific to account type

Apex Trader Funding Consistency Rules (for PA accounts)

The 30% Rules:

- No single day can make more than 30% of your total profit

- Keep your open (unrealized) profits under 30% of your max account size

About “Flipping” (Manufacturing Trading Days):

- It’s allowed, but with limits

- Can’t be more than 20% of your total trading days

The Big Picture: These rules are designed to help you trade steadily and safely, rather than making wild bets. They want you to develop good trading habits that last.

Contract Management and Risk Parameters

Position Size Rules:

- Keep your contract sizes consistent

- Start with half your allowed contracts until you pass your “safety net” level

- Risk:Reward ratio can’t be more than 5:1

Good News: (maybe)

- You can now use dollar cost averaging (adding to negative positions, (be careful with this one!)

The Bottom Line: While Apex gives you some freedom in how you trade, you need to follow these rules carefully. They’re designed to help you trade safely while still making good profits.

Remember: Success with Apex Trader Funding comes from understanding and following these rules while sticking to your trading strategy.

- 30% Rule: No more than 30% of profit can come from a single trading day

- Max 20% Flipping: No more than 20% of trading days can involve flipping

- Contract Size Consistency: Maintain overall consistency in contract sizes

- Risk Management: Maximum of 5:1 (Risk:Return)

- Do not exceed 30% of your max account size in unrealized gains

- Dollar cost averaging is OK now

- Flipping is OK now (manufacturing a trading day)

- You can only trade half of your full contract size until over “safetynet”

Prohibited Activities

- News trading strategies

- Fully automated trading systems

- Hedging or trading correlated instruments in opposite directions

- High risk inconsistent trading styles

Apex Trader Funding Payout Process

Profit Split:

- First $25,000: You keep 100%

- After $25,000: You keep 90%

To Get Your First Payout, You Need:

- At least 8 trading days

- 5 profitable days (making $100+ each)

- Stay above your “safety net” (trailing drawdown) level

Extra Benefits:

- Request payouts anytime – no set schedule

- After your 6th payout, you can withdraw your entire balance

The Big Picture: Apex offers one of the best profit-sharing deals out there. They reward both quick wins and long-term success, while keeping things flexible with their payout timing.

- 100% of the first $25,000 per account, 90% of profits thereafter

- Minimum 8 trading days to request a payout

- No payout windows to request payouts

- Must have 5 days of trading with $100+ profit to request payout

- “safetynet” = your trailing drawdown amount

- Must be over your “safetynet” to request a payout

- By the 6th payout you can request 100% of account balance

Fees and Billing

Evaluation Account Fees

Initially, traders begin with a monthly subscription model for evaluation accounts

Moreover, these subscription payments continue until either achieving funded status or choosing to cancel.

All subscriptions automatically renew every 30 days unless specifically canceled by the trader. This is per trading account. If you have 20 accounts, you have 20 monthly subscriptions.

Performance Account (PA) Options

Once funded, traders can choose between two distinct payment structures:

Primarily, a flexible monthly fee option for those preferring lower upfront costs and, a one-time lifetime fee wich rewards longevity. Lately the sales at Apex have encouraged traders to take the “lifetime” option at $85, but this is subject to change.

Important Billing Policies

Most notably, all fees are subject to strict non-refund policies, which specifically applies to:

Monthly subscription payments

Account reset fees

Any other service-related charges

Automatic renewals occur precisely every 30 days, therefore requiring proactive cancellation if needed

- Monthly subscription for evaluation accounts

- PA accounts have monthly fee options or one-time lifetime fee

- Automatic 30-day renewal unless canceled

- No refunds on subscription fees or resets

Apex Trader Funding Platforms and Instruments

Trading Platforms

Rithmic RTrader Pro

Tradeovate

NinjaTrader (free license provided)

Tradingview

Tradable Instruments, Traditional Futures:

Stock market indexes

Currencies

Agricultural products

Energy (oil, gas)

Metals (gold, silver, etc.)

Micro futures (smaller contract sizes)

Crypto Futures:

Micro Bitcoin

Micro Ethereum

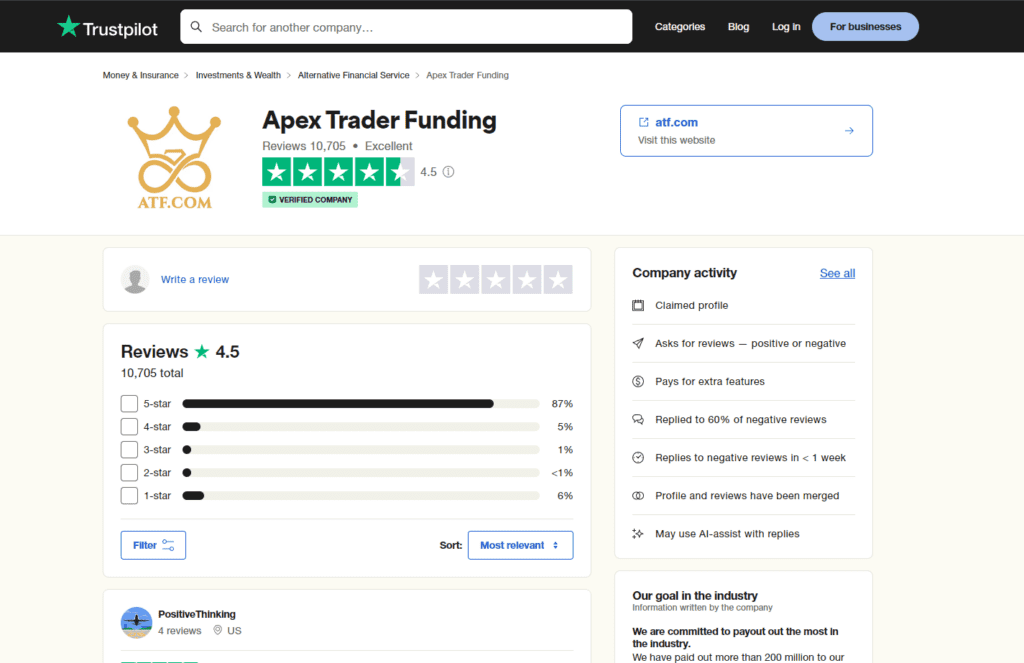

Apex Trader Funding Trustpilot Reviews And Statistics

Trustpilot Reviews Overall Rating Distribution

5 stars: 771 reviews (77.1%)

4 stars: 33 reviews (3.3%)

3 stars: 20 reviews (2.0%)

2 stars: 8 reviews (0.8%)

1 star: 168 reviews (16.8%)

Average Rating: 4.23 out of 5 stars

Themes and Statistics

1. Apex Trader Funding Payout Proceess

The Numbers:

25% of traders reported good payout experiences

10% had some issues getting paid

What Traders Like:

Regular payments

Professional handling

Clear updates throughout

Common Issues:

Breaking rules by accident

Wrong paperwork

Misunderstanding the rules

Payout Speed:

Used to take 7-14 days

NOW: Less than 3 days! (Recent update)

Looking at what traders say about Apex’s payouts tells us a lot. A quarter of traders specifically mentioned having good experiences getting paid, praising Apex’s professional approach and clear communication. However, about 10% ran into problems, usually because of accidentally breaking rules or paperwork issues.

The good news? While payouts used to take 7-14 days, Apex recently improved their system – now you can get your money in less than 3 days.

The key to smooth payouts? Make sure you know and follow all the rules carefully.

2. Apex Trader Funding Customer Support

The Numbers:

30% of traders praised great support

Only 5% reported problems

Most get answers within 24-48 hours

What Traders Love:

Staff who understand trading

Clear explanations

Good at solving problems

Common Issues:

Slower replies during busy times

Some complex issues take longer

Sometimes unclear answers

Apex’s customer support gets strong marks from traders. A impressive 30% of traders went out of their way to praise the support team, especially how well they understand trading and explain things clearly. Only 5% reported having problems, usually during busy times or with complex issues. Most traders get answers within 24-48 hours, and urgent problems get faster attention. Bottom line? Apex seems to take support seriously – their team knows trading, explains things well, and actually solves problems when they come up.

3. Apex Trader Funding Rules And Compliance

The Numbers:

15% of traders stressed how important the rules are

8% found some rules hard to understand

What Successful Traders Do:

Learn all rules carefully

Keep up with rule changes

Track their trades closely

Review rules regularly

Common Challenges:

Understanding new rule changes

Figuring out complex rules

Keeping up with updates

When it comes to Apex’s rules, traders have a clear message: knowing and following them is crucial for success. About 15% of traders specifically emphasized how important the rules are, while 8% mentioned having some trouble understanding them. Successful traders say the key is to learn the rules thoroughly, stay updated on any changes, and keep good records of your trades.

The main challenges? Understanding when rules change and figuring out some of the more complex requirements. Bottom line: if you want to succeed at Apex, take the rules seriously and make sure you understand them completely.

4. Apex Trader Funding Platform and Technology

The Numbers:

10% of traders loved the platforms

Only 5% reported technical issues

What Works Well:

Fast trade execution

Reliable market data

Easy-to-use interface

Good charting tools

Quick order placement

Common Issues:

Sometimes loses connection

Data feed hiccups

Learning new platform features

Most problems fixed quickly

Looking at what traders say about Apex’s platforms tells a positive story. About 10% of traders specifically praised the platforms, highlighting fast trades, reliable data, and user-friendly tools. While 5% mentioned having some technical issues like connection problems or data interruptions, these usually got fixed quickly through support.

Most traders seem happy with how the platforms work, especially the quick order entry and good charting tools. When problems do pop up, they’re usually short-lived and don’t seriously impact trading.

5. Apex Trader Funding Evaluation Process & Success Metrics

Successful Evaluation Experiences

- 20% of reviewers specifically highlight their successful evaluation completions, emphasizing:

- Clear understanding of objectives

- Achievable profit targets

- Reasonable drawdown parameters

- Successful traders frequently mention:

- The value of proper preparation

- Benefits of the no-time-limit approach

- Appreciation for flexible trading requirements

- Strategic adaptation to trailing drawdown rules

Evaluation Challenges

- However, approximately 5% of reviews document specific difficulties, particularly noting:

- Initial adjustments to trading parameters

- Understanding trailing drawdown mechanics

- Managing position sizing requirements

- Moreover, traders facing challenges typically cite:

- Learning curve with platform specifics

- Adaptation to risk management rules

- Need for strategy refinement

The significant success rate (20%) compared to reported difficulties (5%) suggests a generally achievable evaluation system.

6. Apex Trader Funding Promotions And Discounts

The Numbers:

15% praised the fair prices

10% loved the special deals

Total: 25% happy with costs

What Traders Like:

Affordable to get started

Reasonable monthly fees

Fair reset costs

Different account sizes to choose from

Clear pricing – no hidden fees

Deals and Discounts:

Regular sales

Seasonal specials

Special pricing events

Traders seem to think Apex gives good value for money. A solid 25% of traders specifically mentioned pricing, with 15% praising the fair costs and 10% highlighting great promotional deals. They like that it’s affordable to get started, the monthly fees make sense, and reset costs don’t break the bank. Plus, Apex regularly offers sales and special deals, making it even more affordable.

The different account sizes let you start where you’re comfortable, and there’s no mystery about what things cost – it’s all clear upfront.

7. Apex Trader Funding Transparency and Communication

The Numbers:

10% praised clear communication

5% wanted better updates

What Works Well:

Clear trading rules

Upfront about costs

Regular updates

Easy to find information

Open about changes

Areas for Improvement:

Sometimes slow to announce changes

Complex rules need better explanations

More advance notice for updates

Could use more detailed guides

When it comes to keeping traders informed, Apex gets mostly good feedback. About 10% of traders specifically praised how clear and open Apex is about their rules, costs, and changes. They like getting regular updates and find it easy to understand what’s expected. However, 5% of traders thought things could be better, mainly wanting faster updates about changes and clearer explanations of complex rules.

While most traders feel Apex does a good job with communication, they’re still working on making things even clearer and giving more advance notice about changes.

8. Apex Trader Funding Trader Development

The Numbers:

10% of traders said they became better traders

Main Improvements:

Better trading discipline

Smarter risk management

Stronger trading strategies

Key Learning Areas:

Position sizing

Emotional control

Market analysis

Trade execution

Following rules consistently

According to feedback, Apex helps traders grow into better professionals. About 10% of traders specifically mentioned how they improved while trading with Apex. The biggest gains? Better discipline, smarter risk management, and stronger trading strategies. Traders say they got better at specific skills too – like choosing the right position sizes, keeping emotions in check, analyzing markets, and executing trades more precisely.

The strict rules and clear performance tracking seem to help traders develop good habits and become more professional overall.

Apex Trader Funding Key Takeaways

- Trailing drawdown on all accounts

- 10 Trading days required to request payout

- 30% daily consistency rule on PA accounts

- 30% max unrealized requirement

- Empasis on consistency in trading style

- Rules change frequently

- Trade up to 20 accounts simultaneously

- Least expensive evaluations

- Tradeovate connection

- Largest prop trading firm

- Updated fast payout schedule

- 100% profit split on first $25,000

- 80/20 profit split after

- Least expensive E-mini commission in the industry

- DCA Allowed as of Oct 21st 2024

Conclusion on Apex Trader Funding

Apex Trader Funding stands out as a premier platform for ambitious disciplined traders seeking to demonstrate their expertise and ultimately launch a rewarding trading career. In particular, several distinctive features position this firm as an exceptional choice for specific types of traders.

The most attractive part for consistent traders is Apex Trader Funding’s unique capacity to accommodate up to 20 simultaneous trading accounts through a trade copy system (link below to Flow Bots Replikanto trader copier).

Additionally, the platform distinguishes itself through remarkably competitive pricing, offering notably the lowest E-mini Micro commissions in the industry. Furthermore, their commitment to rapid payout processing adds another compelling advantage for active traders.

Consequently, these outstanding features, combined with their overall cost-effectiveness and trader-friendly approach, have earned Apex Trader Funding the prestigious #4 position on our comprehensive list of Top Prop Trading Firms. Indeed, for traders who value efficiency, scalability, and cost-effectiveness, Apex presents an incredibly attractive opportunity to advance their trading careers.

If you’re a disciplined trader seeking a reliable platform that offers exceptional value, extensive account options, and proven reliability, Apex Trader Funding merits serious consideration as your trading partner. Be sure to follow all of their rules, do not take large trads, and understand that some traders have recently been denied payouts. All this considered they have been around a long time and continue to payout. The have been somewhat consistent with their rules lately and the payout speeds are faster. This put Apex Trader Funding #4 on our list of Top Prop Trading Firms of 2025.

Apex Trader Funding Current Discounts/Coupon Codes

| Coupon | Product(s) | Discount |

|---|---|---|

| PropPlus | All evaluation accounts | 80% |

Restricted Countries

Afghanistan, Côte d’Ivoire, Laos, Slovenia, Albania, Crimea, Lebanon, Somalia, Algeria, Croatia, Liberia, South Sudan, Angola, Cuba, Libya, Sri Lanka, Bahamas, Democratic Republic of Congo, Mauritius, Sudan, Barbados, Ecuador, Mongolia, Syria, Belarus, Ethiopia, Montenegro, Trinidad and Tobago, Bosnia and Herzegovina, Ghana, Nicaragua, Tunisia, Botswana, Iceland, North Korea, Turkey, Bulgaria, Indonesia, Pakistan, Uganda, Burma (Myanmar), Iran, Panama, Ukraine, Burundi, Iraq, Papua New Guinea, Vietnam, Cambodia, Jamaica, Russia, Venezuela, Central African Republic, Kosovo, Serbia, Yemen, and Zimbabwe.

As of October 8th 2024, the following countries are also restricted from purchasing: Burkina Faso, Kenya, Philippines, Cameroon, Macedonia, Qatar, China, Mali, Romania, Gibraltar, Mozambique, Senegal, Haiti, Myanmar, South Africa, Hong Kong, Namibia, Tanzania, Jordan, Nigeria, and United Arab Emirates.

Apex Trader Funding Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools of 2025

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!