TakeProfit Trader Review & Discounts 2026

Take Profit Trader is an exceptional platform that offers traders the chance to achieve live funding through performance in simulated accounts. We’re passionate about TakeProfit Trader—we trade with them daily, and they’ve earned our #1 spot on the Top Prop Firms list for 2025. Here’s why we’ve chosen them as the best, and why so many other traders agree that TakeProfit Trader is the leading prop firm of 2025.

See the most recent TakeProfit Trader sales & promotions below

Account Types and Structure

1. TakeProfit Trader Evaluation Accounts: $25K, $50K, $75K, $100K, $150K

TakeProfit Trader offers Evaluation Accounts in sizes ranging from $25,000 to $150,000, each equipped with an end-of-day drawdown feature that helps traders effectively manage risk. What’s even more appealing is the flexibility—traders can operate up to five accounts simultaneously, giving you the potential to diversify strategies and amplify profits.

The evaluation is designed to promote consistent and steady performance. With a daily loss limit in place, traders are encouraged to maintain discipline, while a 1:10 micro-to-mini scaling ratio ensures a smooth progression in trade size. To pass, traders need to complete a minimum of five trading days, and no more than 50% of the profit target can be achieved in a single day—further reinforcing stability and sustainable growth.

Key features include:

End-of-Day Drawdown: Keeps risk in check and encourages disciplined trading.

Up to 5 Accounts: Flexibility to manage multiple accounts and strategies.

Daily Loss Limit: Safeguards capital and promotes consistent risk management.

1:10 Micro-to-Mini Scaling: A gradual progression that suits traders of all levels.

Minimum 5 Trading Days to Pass: Ensures consistency over time.

Profit Stability Requirement: No more than 50% of the profit target can be met in one day, favoring sustainable growth.

With these features, TakeProfit Trader is designed to support traders in achieving success and honing their skills in a structured, performance-driven environment.

2. TakeProfit Trader PRO Accounts: $25K, $50K, $75K, $100K, $150K

TakeProfit Trader’s PRO accounts offer substantial advantages for traders who successfully pass the evaluation. Without a consistency rule, traders enjoy more freedom to explore and implement diverse strategies that best suit their trading style. Each PRO account includes a trailing drawdown until reaching the buffer, combined with a daily loss limit to support effective risk management.

A key benefit of the PRO account is immediate access to funds—there’s no minimum number of trading days required for withdrawals, allowing traders to cash out profits quickly. The profit split is also highly rewarding: traders receive a 50/50 split if their account balance is below the buffer, but as soon as it’s above, they keep 80% of profits in an 80/20 split. For those aiming to scale, TakeProfit Trader permits up to five active PRO or PRO+ accounts, maximizing earning potential across multiple accounts.

To support continuous improvement, TakeProfit Trader offers a simulated environment where traders can practice and refine their strategies before stepping into live trading.

PRO Account Benefits at a Glance:

Granted Upon Evaluation Success: Unlocks advanced trading opportunities.

No Consistency Rule: Provides flexibility for varied trading approaches.

Trailing Drawdown & Daily Loss Limit: Encourages steady risk management.

Instant Withdrawals: No minimum trading days, so profits are accessible when earned.

Profit Split Structure:

50/50 if below the buffer; 80/20 in favor of the trader if above.

Up to 5 Active PRO Accounts: Expand your strategy and earning potential.

Simulated Practice Environment: Ideal for perfecting trades before going live.

With these advantages, TakeProfit Trader’s PRO accounts are designed to empower traders with flexibility, fair profit-sharing, and valuable resources for ongoing growth.

3. TakeProfit Trader PRO+ Accounts: $25K, $50K, $75K, $100K, $150K

The PRO+ accounts at TakeProfit Trader are an elite upgrade to the standard PRO accounts, delivering enhanced benefits designed to empower high-performing traders. A standout feature of the PRO+ account is its $0 margin requirement for live trading, making these accounts more accessible and freeing up capital for other trading opportunities. With a generous 90/10 profit split, traders retain 90% of their earnings, maximizing their rewards from successful trades.

These accounts also eliminate the daily loss limit, offering even more freedom in trading decisions and enabling traders to execute strategies without restrictive loss constraints. PRO+ accounts also provide direct routing to the exchange for efficient trade execution, which means orders are processed faster and with less slippage—an essential feature for serious traders.

Another major advantage of PRO+ accounts is the removal of the buffer zone requirement found in standard PRO accounts. This simplifies account management, allowing traders to focus more on their trading strategies. While these accounts are offered to traders who reach a $5,000 profit in their PRO account, there’s no strict requirement to achieve this milestone to open a PRO+ account, giving traders flexibility on when to upgrade. Plus, with the ability to manage up to five PRO+ accounts simultaneously, traders have more avenues to scale their strategies and increase their profit potential.

Key Advantages of TakeProfit Trader’s PRO+ Accounts:

Enhanced Version of PRO Accounts: Built for serious traders seeking advanced features. $0 Margin Requirement: Fully accessible live accounts with no margin constraints. 90/10 Profit Split: Traders keep 90% of their profits for maximum reward.

No Daily Loss Limit: Greater flexibility to explore diverse trading strategies.

Direct Exchange Routing: Ensures efficient trade execution with minimal delay.

No Buffer Zone Requirement: Streamlines account management and focuses on trading.

Available to Profitable PRO Traders: Accessible after achieving $5,000 in profits, but not required at this level. Manage Up to 5 Accounts: Expand trading opportunities and boost earning potential. With these exclusive features, TakeProfit Trader’s PRO+ accounts offer the ultimate environment for traders looking to maximize their earnings and operational flexibility, making them an excellent choice for those committed to growth and success in the market.

TakeProfit Trader Evaluation Process and Test Rules

Hit Your Profit Target: Rule 1

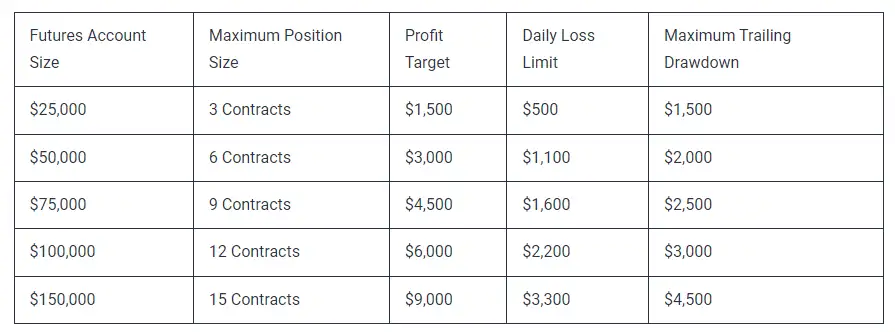

To hit your profit target, each account size comes with a specific goal, from $1,500 for $25,000 accounts up to $9,000 for $150,000 accounts. Maintaining discipline is crucial: you must not exceed the daily loss limit, which varies by account size and applies to unrealized losses; surpassing it will result in immediate account liquidation.

Additionally, never hit the end-of-day (EOD) maximum trailing drawdown, which is recalculated daily and follows the account balance upwards; reaching the minimum balance will trigger liquidation. Only approved products from CME, CBOT, NYMEX, and COMEX can be traded during the allowed hours of 6 PM to 5 PM Eastern, with no overnight positions (exceptions apply to certain accounts). Consistency is key, requiring a minimum of five trading days and limiting any single trading day to no more than 50% of total profits. Flipping is currently acceptable.

- Each account size has a defined profit target

- Profit targets range from $1,500 for $25,000 accounts to $9,000 for $150,000 accounts

Do Not Exceed Maximum Position Size: Rule 2

Staying within your maximum position size is crucial for effective risk management in trading. While most platforms will not permit exceeding this limit, it ultimately remains the trader’s responsibility to adhere to these guidelines. Each account size has a static number of contracts allowed, which varies based on the account balance. For instance, $25,000 accounts are permitted to trade up to 3 contracts, while $150,000 accounts can trade as many as 15 contracts. Additionally, traders can take advantage of a 10x position size on Micro products, which provides greater flexibility for those trading smaller contracts.

By understanding and respecting these position size limits, traders can better manage their risk and enhance their overall trading strategy.

- Static Contract Limits Tied to Account Size: Each account size has a fixed limit on the number of contracts that can be traded, keeping risk proportional to account value.

- Ranges from 3 to 15 Contracts: For example, $25,000 accounts are allowed up to 3 contracts, while $150,000 accounts can trade up to 15 contracts.

- 10x Position Size for Micro Products: To further enhance flexibility, Micro products allow for a position size that’s 10 times the standard, giving traders more room to manage smaller trades effectively with some of the lowest micro E-mini commission in the industry.

Do Not Hit End-Of-Day (EOD) Maximum Trailing Drawdown: Rule 3

Traders must never hit the end-of-day (EOD) maximum trailing drawdown, as this critical threshold is calculated at the end of each trading day. The trailing drawdown is designed to follow the account balance as it increases, ensuring that traders can benefit from their profits while still maintaining a safety net. However, if the account balance falls to the minimum level, it will result in immediate liquidation of the account, which can have devastating financial consequences.

Therefore, it is vital for traders to monitor their performance closely and implement effective risk management strategies to avoid breaching this limit. By doing so, they can safeguard their capital and enhance their trading longevity.

- Calculated at the End of Each Trading Day: First, the trailing drawdown is recalculated at the close of each trading day, giving traders a daily update on their account status.

- Adjusts Upward as Account Balance Increases: As profits are made, the trailing drawdown follows, moving up alongside the account balance to allow for more trading flexibility.

- Results in Immediate Liquidation if Minimum Balance is Reached: However, if the account balance drops to the minimum allowed by the trailing drawdown, liquidation will occur right away to protect the remaining capital and enforce trading discipline.

Trade Approved Products, During Approved Hours: Rule 4

Primarily, the trailing drawdown is recalculated at the close of each trading day, thereby providing traders with a comprehensive daily update on their account status.

Subsequently, as profits accumulate over time, the trailing drawdown automatically adjusts upward, moving in tandem with the growing account balance. Consequently, this upward adjustment creates more trading flexibility while maintaining risk management parameters.

Nevertheless, if the account balance eventually drops to the minimum threshold established by the trailing drawdown, immediate liquidation will occur. This swift action serves two critical purposes: first, it safeguards the remaining capital from further losses, and second, it effectively enforces strict trading discipline throughout the process.

Be Consistent: Rule 5

First and foremost, traders must maintain active accounts for a minimum of five trading days, which serves as a foundational requirement to demonstrate consistent trading engagement and strategy implementation.

Regarding trading styles, while day trading and position flipping are currently permitted – enabling traders to take advantage of short-term market fluctuations – there is one crucial limitation: no single trading day’s profits can exceed 50% of the total accumulated profits. For instance, if total profits are $10,000, no single day should generate more than $5,000 in gains.

These carefully structured guidelines serve multiple purposes. Primarily, they encourage balanced and sustainable trading practices. Additionally, they help prevent excessive risk-taking within individual sessions. Furthermore, they foster the development of disciplined, long-term trading approache

Key Consistency Rules at a Glance:

Mandatory minimum of 5 active trading days

Position flipping currently allowed and supported

Daily profit cap: 50% of total accumulated profits

By following these measured guidelines, traders can build a more robust and sustainable trading framework while maintaining flexibility in their strategies.

TakeProfit Trader PRO Account Rules

Let’s dive into TakeProfit’s key trading parameters – rules you’ll absolutely need to know inside and out. Understanding these guidelines is crucial for maintaining your funded status.

Critical Trading Requirements:

Front and center, only trade approved instruments during designated market hours

Keep a close eye on that intraday trailing drawdown – hit the limit, and you’re done for the day. Make sure to place at least one trade weekly to keep your account active and healthy

Market-Specific Restrictions:

Here’s a big one – steer clear of trading during any rare limit up or limit down conditions

When it comes to major economic news releases:

No positions around tier 1 news events (think FOMC, NFP, CPI)

Specifically, maintain a 1-minute buffer before and after these heavy hitters.

Why does all this matter? Well, TakeProfit’s built these rules with a clear purpose – keeping traders safe while letting them do their thing. Each requirement serves as a strategic guardrail rather than a roadblock to your trading success.

Bottom line? While nobody loves rules, these guidelines actually help protect your capital and trading career. Master these parameters, and you’re setting yourself up for long-term success with TakeProfit.

- Trade only approved instruments during trading hours

- Do not exceed the maximum intraday trailing drawdown limit

- Trade at least once per calendar week to keep the account active

- No trading during limit up or limit down periods

- Adhere to tier 1 news trading restrictions (e.g., FOMC, NFP, CPI) No trades 1 minutes before during or after major economic news.

TakeProfit Trader PRO+ Setup Process

After reaching a significant milestone of $5,000 in profits within their PRO account, qualifying traders can begin their journey to PRO+ status. Subsequently, the initial step involves completing a Power of Attorney (POA) document, which thereby establishes the necessary legal framework for account management.

Processing Timeline and Transition Period:

As soon as the documentation is submitted, the setup process typically extends over 1 to 2 business days. Throughout this transition phase, several key changes unfold:

First, professional market data fees are automatically covered for all previously utilized exchanges. Meanwhile, the original PRO account is temporarily suspended

and, the $5,000 profit remains frozen throughout the setup process

Consequently, during the final setup phase, traders should understand that:

Initially, trading access to the PRO account may be temporarily restricted

Simultaneously, the frozen $5,000 profit remains secured in the original account

In addition, the new PRO+ account is prepared for activation

New Account Initialization: Once the setup process concludes, the PRO+ account launches with:

Primarily, a fresh starting balance of $0

Moreover, an allocated initial intraday drawdown amount

Additionally, enhanced trading capabilities and benefits

Ultimately, this structured transition ensures a professional upgrade while consistently maintaining account security and proper documentation throughout the process.

TakeProfit Trader Profit Split and Withdrawal Rules

PRO Accounts

Initially, traders benefit from a favorable 80/20 profit split, whereby they retain 80% of their earnings. However, if traders choose to withdraw funds before reaching the designated “buffer zone” (which equals the maximum drawdown amount), or if they have accumulated fewer than 60 trading days, then the split automatically reverts to 50/50, and consequently, the account must be closed.

Withdrawal Guidelines and Buffer Zone:

Once traders successfully reach the buffer zone threshold, withdrawals become permissible. Furthermore, it is strongly recommended to maintain this buffer zone until the final account closure. Additionally, for enhanced flexibility, traders can access daily withdrawal options as needed.

In contrast, PRO+ Account Benefits:

Meanwhile, PRO+ accounts offer significantly enhanced benefits, including:

Primarily, an upgraded 90/10 profit split

Furthermore, no daily loss limits. Moreover, no buffer zone requirements

Most notably, the freedom to withdraw all profits starting from day one without any restrictions

Key Points at a Glance:

First, standard accounts maintain an 80/20 profit division

However, early withdrawals or insufficient trading days trigger a 50/50 split

Subsequently, the account must close under these conditions

Nevertheless, once the buffer zone is achieved, regular withdrawals are permitted

Finally, maintaining this buffer until account closure is highly recommended for optimal account stability

PRO+ Accounts Structure and Bennefits

Initially, PRO+ accounts follow many of the core PRO account guidelines; however, they do incorporate additional restrictions specifically regarding news events for certain trading instruments. Yet despite these news-related constraints, the account offers substantial advantages.

Primary Trading Benefits:

First and foremost, traders enjoy a highly favorable 90/10 profit split. Additionally, and perhaps most significantly, there is no daily loss limit imposed, which therefore provides traders with expanded flexibility in their trading approach.

Withdrawal and Management Features:

Moreover, PRO+ accounts eliminate the buffer zone requirement, thus streamlining account management considerably. Furthermore, traders gain the valuable benefit of withdrawing all profits starting from day one, without any restrictions or limitations.

Key Advantages at a Glance:

Primarily, an exceptional 90/10 profit split and subsequently, unrestricted trading without daily loss limits. Additionally, freedom from buffer zone requirements

Finally, access to profit withdrawals from the first day

Ultimately, while traders must remain mindful of specific news-related trading restrictions, these enhanced features collectively create a more flexible and potentially lucrative trading environment.

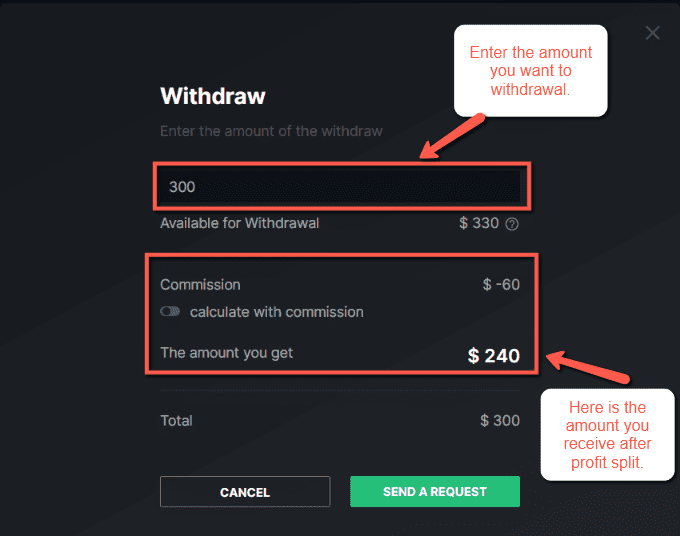

Withdrawing from PRO Account to Wallet

Initially, the process of transferring funds from your PRO account to your wallet follows a simple, systematic approach. To begin, navigate to the Control Center where you’ll first locate and select the ‘Withdraw’ button.

Subsequently, you’ll need to specify your desired withdrawal amount. During this step, it’s important to note that the system automatically calculates and deducts a 20% commission from your total withdrawal amount. Therefore, the final amount you receive will reflect this deduction.

Once you’ve confirmed your withdrawal amount, proceed by submitting your request for review. Although processing typically requires only a couple of hours, occasionally it may extend up to 24 hours for complete verification.

Finally, after your withdrawal receives approval, the funds will consequently appear in your wallet, thereby providing immediate access to your earnings.

Step-by-Step Summary:

Firstly, access the Control Center and locate the ‘Withdraw’ button

Next, input your desired withdrawal amount

Meanwhile, the system calculates the 20% commission deduction

Then, submit your request for processing

Ultimately, await fund transfer to your wallet (within 24 hours)

This streamlined process thus ensures efficient fund management while maintaining security throughout the withdrawal procedure.

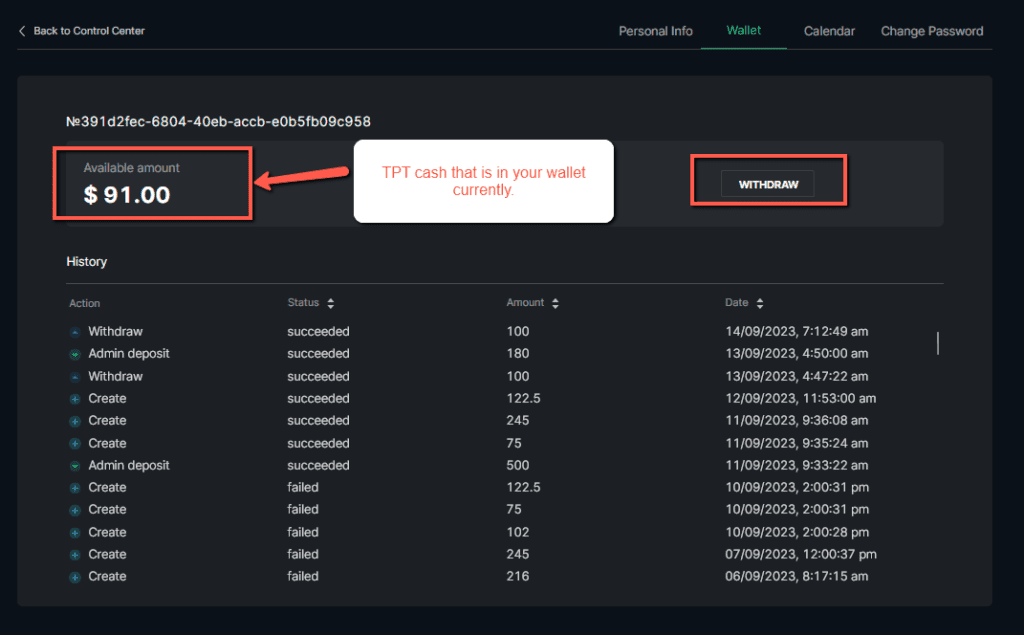

Withdrawing from Wallet

Initially, begin by accessing your account on takeprofittrader.com and navigating directly to the wallet section. Subsequently, locate and select the ‘Withdraw’ button to submit your payout request.

Following submission, the request enters an admin review phase, which typically takes up to 12 business hours for approval. Once approved, the process then diverges based on your location:

For US-Based Traders: First, you’ll need to complete identity verification through Plaid, which ensures secure connection to your bank account. Afterward, the transfer process begins automatically.

Meanwhile, for Non-US Traders: Instead of Plaid verification, you’ll need to provide either Wise or PayPal account information for fund transfer processing.

Final Transfer Stage: Ultimately, regardless of location, once all verifications are complete, the funds typically appear in your designated account within seconds. This streamlined process therefore ensures efficient and secure access to your trading profits.

Quick Reference Timeline:

- First, access wallet section

- Next, submit withdrawal request

- Then, await admin approval (≤12 hours)

- Subsequently, complete verification (Plaid/Wise/PayPal)

- Finally, receive funds (usually within seconds)

TakeProfit Trader Payout Options

TakeProfit’s Distinguished Payout System

Standing at the forefront of innovation, TakeProfit sets itself apart in the proprietary trading industry through its exceptionally streamlined and versatile payout system, consequently emerging as an industry leader in payment processing speed.

Instant Payout Solutions Through Plaid: Initially, US traders benefit from:

- Primarily, direct bank transfers via Plaid integration

- Furthermore, same-day processing capabilities

- Additionally, automated verification systems

- Moreover, robust secure banking protocols

Enhanced Service Features: Subsequently, this instant solution delivers:

- First, zero processing fees

- Additionally, immediate fund accessibility

- Furthermore, an intuitive user interface

- Meanwhile, reliable transaction tracking

International Payment Solutions:

PayPal Services (Including US): In particular, international traders gain advantages through:

- Initially, universal payment accessibility

- Moreover, comprehensive currency support

- Furthermore, established security measures

- Additionally, rapid fund transfers

Wise Platform Integration: Similarly, Wise transfers provide unique benefits:

- Primarily, market-leading exchange rates

- Subsequently, reduced international fees

- Furthermore, multi-currency account options

- Finally, complete cost transparency

Quick Reference Options:

- Initially, instant Plaid payouts (US banks exclusively)

- Subsequently, PayPal services (both international & US)

- Finally, Wise platform (international focus)

Ultimately, through this comprehensive payout framework, TakeProfit effectively serves its global trading community. Therefore, traders can confidently select their preferred withdrawal method based on geographical location and specific needs. Above all, this multi-channel approach to payouts demonstrates TakeProfit’s unwavering commitment to providing efficient and accessible fund distribution options across their international user base.

TakeProfit Trader Withdrawal Fees

TakeProfit implements a straightforward fee system for withdrawals, designed to encourage larger, more efficient payouts while maintaining operational sustainability. Most significantly, traders benefit from zero fees on withdrawals exceeding $250, providing complete fee transparency and a predictable cost structure. This approach effectively encourages strategic withdrawal planning and efficient fund management among traders.

Traders should carefully note that a $50 processing fee applies to all withdrawals of $250 or less, with no exceptions or waivers available regardless of payment method chosen. Moreover, when utilizing PayPal as the withdrawal option, additional platform fees may apply, with percentages varying by region and potential currency conversion costs determined by PayPal’s current rates.

Consequently, traders can optimize their withdrawal strategy by planning larger withdrawals to avoid unnecessary fees. Above all, understanding these fee parameters helps traders maximize their profit retention through strategic withdrawal planning, making it crucial to consider timing and amount when requesting payouts.

- No fees for withdrawals over $250

- $50 fee for withdrawals of $250 or less

- Additional PayPal fees may apply if chosen as the payout option

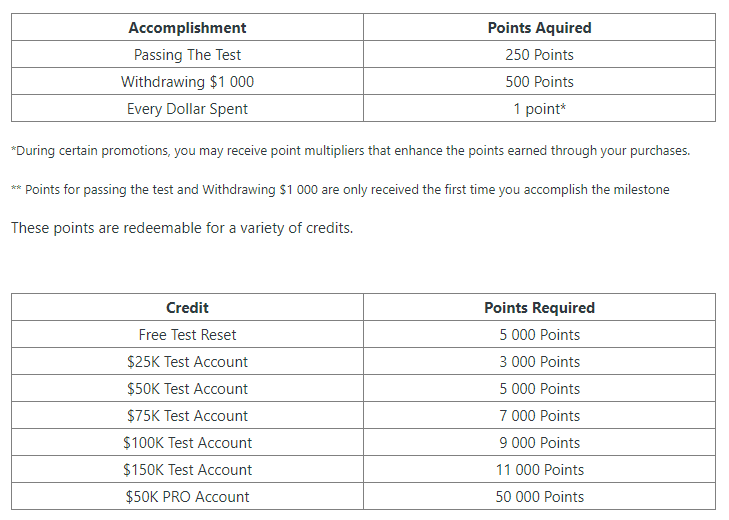

TakeProfit Trader Rewards System

Earning Points

At its core, the rewards system operates through a strategic point-earning framework. Initially, traders earn 250 points upon successfully passing their test. Subsequently, reaching the milestone of $1,000 in withdrawals generates an additional 500 points. Meanwhile, every dollar spent continuously accumulates 1 point, with periodic promotions potentially offering enhanced earning opportunities.

Primarily, free test resets

Additionally, new test accounts of various sizes

Furthermore, PRO account activations

Tier System Benefits:

Moreover, the program incorporates a dynamic tier system that rewards consistent trading activity. As traders progressively accumulate points, they consequently advance through higher tiers, where each advancement therefore unlocks increasingly valuable credit options.

Point Earning Overview:

Initially, 250 points for test completion

Furthermore, 500 points for $1,000 withdrawal milestone

Additionally, 1 point per dollar spent

Subsequently, bonus points during promotional periods

Importantly, to maintain tier status and benefits, traders must demonstrate activity within a 12-month period. Otherwise, tiers automatically reset, thus encouraging sustained platform engagement and regular trading activity.

Redeeming Points

Accumulated points can be redeemed for a variety of valuable credits, offering traders flexibility in enhancing their accounts and trading options. Points may be used toward free test resets, providing a cost-effective way to continue practice sessions.

Additionally, traders can redeem points for test accounts of different sizes, allowing them to explore and adapt to various account types. PRO accounts are also available as a redemption option, giving traders the chance to advance their trading experience and progress through account levels.

This rewards system empowers traders to leverage their points strategically, supporting the cost of ongoing development and adaptability in their trading journey.

- Points can be redeemed for various credits, including:

- Free test resets

- Test accounts of different sizes

- PRO accounts

Using Credits

Credits may be applied to reset test accounts, allowing traders to restart and refine their strategies without additional fees. They can also use credits to acquire new test accounts, expanding their practice opportunities across different account sizes. Furthermore, credits can activate free PRO accounts, enabling traders to progress to more advanced account types. This flexible use of credits empowers traders to tailor their trading environment and adapt to evolving goals.

- Reset test accounts

- Acquire new test accounts

- Activate free PRO accounts

TakeProfit Trader Tier System

- Accumulate points to ascend the Tier ladder

- Higher Tiers offer more valuable credits

- Tiers reset if no account activity for 12 consecutive months

TakeProfit Trader Account Reset Options

Test Accounts

Test accounts can be reset for a fee of $100 or by utilizing available credits, providing traders with options to maintain their practice sessions. However, it is often more economical to purchase a new account using the promotional code “BUYLOW,” which can lead to significant savings. This flexibility allows traders to choose the best option for their needs, whether they prefer to reset their current account or take advantage of promotional offers for a fresh start. By strategically managing test accounts, traders can optimize their learning experience and enhance their skills effectively.

- Can be reset for a fee or using credits $100

- Sometimes less expensive to buy new account with promo code BUYLOW

PRO Accounts

PRO accounts allow for up to three resets, providing traders with the opportunity to recover from challenging trading periods. However, it’s important to note that the reset fee is less than the total available drawdown but exceeds the $100 fee for a standard test reset. As a result, these reset fees can become quite expensive, making frequent resets not recommended for traders looking to manage their costs effectively. By carefully considering the implications of resets, traders can make more informed decisions about their trading strategies and overall account management.

- Allow up to 3 resets

- Reset fee is less than total available drawdown but more than a $100 test reset

- Very expensive and not reccomended

TakeProfit Trader Additional Features

Market Data

All evaluations include Top of Book Level 1 data, providing traders with essential market information to make informed decisions. For those seeking more detailed insights, Depth of Market Level 2 data is available as an add-on, enhancing the trading experience by offering greater visibility into market dynamics.

Additionally, PRO+ accounts may incur professional market data fees, which are $135 per month for access to additional exchanges. This structure allows traders to choose the level of data that best suits their trading strategies while managing their costs effectively. By leveraging the available data options, traders can enhance their market analysis and optimize their trading performance.

- Top of Book Level 1 data included with all evaluations

- Depth of Market Level 2 available as an add-on

- PRO+ accounts may incur professional market data fees ($135/month for additional exchanges)

Trading Platforms

- Support for popular platforms like NinjaTrader, TradingView, and others along wtih a fast and robust CQG connection which we love.

TakeProfit Trader Important Considerations

Traders are responsible for knowing market hours and following trading rules, including an understanding of professional versus non-professional market data status. They must also be aware of restricted trading periods, particularly during major economic news events.

Commissions are set at $5 per round trip per contract for standard E-mini equity index futures and $0.50 for Micros, with an industry-low rate of $0.25 each way for E-mini Micros. For more information on commission see table below.

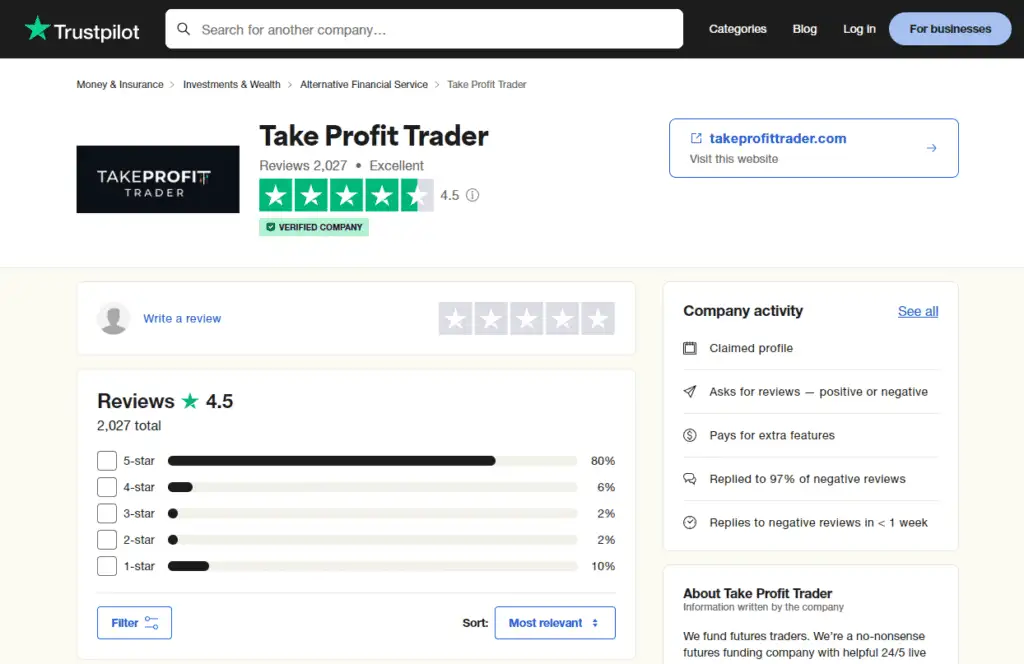

TakeProfit Trader Trustpilot Review Aggregation

TakeProfit Trader Overall Review Statistics

- Total reviews analyzed: 1000

- Average rating: 4.39 out of 5 stars

- 5-star reviews: 78.2%

- 4-star reviews: 6.5%

- 3-star reviews: 4.3%

- 2-star reviews: 1.7%

- 1-star reviews: 9.3

Trustpilot Review Aggregation Key Themes

1. Customer Service (mentioned in 42% of reviews)

TakeProfit Trader consistently receives overwhelmingly positive feedback from its users, highlighting the exceptional support and services offered by the platform. Traders appreciate the quick response times, which ensure that inquiries and issues are addressed promptly. Moreover, the staff is noted for being knowledgeable and helpful, providing valuable assistance to traders at every stage of their journey. Support is readily available through various channels, including live chat and email, allowing traders to choose the method that best suits their needs.

This commitment to customer service contributes significantly to the overall positive experience for traders on the platform.

- Overwhelmingly positive feedback

- Quick response times

- Knowledgeable and helpful staff

- Available through live chat, email, and other channels

2. Payout System (mentioned in 35% of reviews)

Traders greatly appreciate the same-day or next-day payout options offered by TakeProfit Trader, as this feature enhances their cash flow and financial flexibility. Additionally, the ability to withdraw profits daily allows traders to access their earnings quickly, further contributing to a positive trading experience. Moreover, the withdrawal process is transparent and straightforward, ensuring that traders can easily understand and navigate the steps involved.

This combination of prompt payouts, daily withdrawal options, and a clear process reinforces the platform’s commitment to supporting its traders and enhancing their overall satisfaction.

- Same-day or next-day payouts highly appreciated

- Ability to withdraw profits daily

- Transparent and straightforward process

3. Trading Rules and Conditions (mentioned in 30% of reviews)

TakeProfit Trader is generally perceived as a fair and trader-friendly platform, which fosters a positive environment for traders. However, there are some concerns regarding the intraday trailing drawdown in funded accounts, as this can impact trading strategies and risk management. On the other hand, the 5-day minimum trading period for evaluations is appreciated by many, as it allows traders sufficient time to demonstrate their skills and adaptability in varying market conditions.

Overall, while there are areas for improvement, the platform’s commitment to fairness and its understanding of trader needs contribute to its positive reputation.

- Generally perceived as fair and trader-friendly

- Some concerns about intraday trailing drawdown in funded accounts

- 5-day minimum trading period for evaluation appreciated by many

4. Platform and Technology (mentioned in 25% of reviews)

TakeProfit Trader offers seamless integration with popular platforms like TradingView and NinjaTrader, enhancing the trading experience for users who prefer these tools. However, there have been some reports of technical issues or glitches, particularly with the Tradovate platform, which can disrupt trading activities.

Additionally, users have noted that dashboard updates are sometimes delayed, affecting real-time decision-making. Despite these challenges, the overall integration with well-known platforms remains a strong selling point, while the company continues to work on addressing these technical concerns to improve user satisfaction.

- Integration with popular platforms like TradingView and NinjaTrader

- Some reports of technical issues or glitches, particularly with Tradovate

- Dashboard updates sometimes delayed

5. Pricing and Promotions (mentioned in 20% of reviews)

TakeProfit Trader is known for its competitive pricing for evaluations, making it an attractive option for aspiring traders looking to prove their skills. Additionally, frequent promotions and discounts are greatly appreciated by users, as these offers provide extra value and opportunities for savings.

However, there are some concerns regarding the high reset fees associated with Pro accounts, which can impact traders’ overall costs. Despite this issue, the platform’s commitment to competitive pricing and regular promotions contributes positively to its reputation in the trading community.

- Competitive pricing for evaluations

- Frequent promotions and discounts appreciated

- Some concerns about high reset fees for funded accounts

6. Transparency (mentioned in 15% of reviews)

Most traders find TakeProfit Trader to be transparent regarding its rules and processes, which fosters trust and confidence in the platform. This openness allows traders to clearly understand what to expect as they navigate their trading journey. However, there have been some complaints about hidden fees or unclear terms, which can lead to confusion and frustration among users.

While the company’s overall transparency is commendable, addressing these concerns could further enhance the trading experience and solidify its reputation as a trader-friendly platform.

- Most traders find the company transparent about rules and processes

- Some complaints about hidden fees or unclear terms

7. Trader Education and Support (mentioned in 10% of reviews)

Many traders appreciate the daily emails provided by TakeProfit Trader, which offer valuable trading tips and psychology advice. These insights not only enhance trading knowledge but also contribute to better decision-making. Furthermore, some traders have noted significant improvements in their discipline and skills as a result of participating in this program.

By consistently delivering relevant content, TakeProfit Trader supports its users in developing a more effective trading mindset, ultimately leading to greater success in the markets.

- Daily emails with trading tips and psychology advice appreciated

- Some traders noted improved discipline and skills through the program

Areas of Improvement Mentioned:

Several areas of improvement have been mentioned by traders regarding TakeProfit Trader. First and foremost, there is a need for more transparency about funded account reset fees, as clear communication about these costs would help manage trader expectations. Additionally, addressing technical issues with trading platforms is crucial, as resolving glitches can significantly enhance the trading experience.

Furthermore, providing more detailed information about the transition from evaluation to funded accounts would empower traders to better understand the process and prepare accordingly. In addition, considering adjustments to the intraday trailing drawdown rule could offer greater flexibility for traders, enabling them to develop more effective strategies.

Lastly, implementing faster dashboard updates for real-time performance tracking would greatly enhance traders’ ability to monitor their progress and make informed decisions. By focusing on these key areas, TakeProfit Trader can continue to improve its platform and better serve its trading community.

- More transparency about funded account reset fees

- Addressing technical issues with trading platforms

- Providing more detailed information about the transition from evaluation to funded accounts

- Considering adjustments to the intraday trailing drawdown rule

- Faster dashboard updates for real-time performance tracking

Vital Themes From Reviews for Potential Traders for TakeProfit Trader

Account Types

TakeProfit Trader offers a range of account options, including Evaluation accounts (most commonly $25k, $50k, $75k, $100k, and $150k), with PRO accounts accessible after passing evaluations and PRO+ accounts for live trading.Evaluation Period

The evaluation process requires a minimum of 5 trading days, with an end-of-day drawdown to manage risk.Payout Structure

Funded traders can start withdrawing profits from the first day, with no mandatory holding period. Profit splits are structured at 80/20 for PRO accounts and 90/10 for PRO+ accounts.Reset Options

Traders can access up to 3 resets per funded account, though fees can be substantial (e.g., $649 for a 50k account reset).Platform Compatibility

TakeProfit Trader supports Tradovate, NinjaTrader, and TradingView, giving traders flexibility across popular platforms.Customer Support

Support includes live chat during extended hours and email support, with responses typically provided quickly.

These themes highlight TakeProfit Trader’s flexibility, risk management, and supportive infrastructure, making it a strong contender for traders seeking a versatile funded account provider.

Conculsion on TakeProfit Trader

TakeProfit Trader offers an attractive opportunity for skilled day traders looking to trade futures with significant capital. The fast funding process, lowest micro commission, best value on accounts, live chat, rewards program and same day payouts make them our top choice for 2024.

The value they offer with their promotions using code BUYLOW, along with live chat, reputation, same day payouts, overall value, and lowest mico E-mini commission, wallet feature and rewards program puts them second to none in the industry putting them at #1 on our list of Prop Trading Firms for 2025.

Key Takeaways

- Trailing drawdown on funded accounts

- Lowest E-mini micro commission in the industry

- Live chat customer service

- Rewards program

- End of day drawdown on evaluations

- Best overall value

- Same day payouts

- No minimum days to request payout

- CQG connection

- Payouts on blown accounts

- No consistency rules on funded accounts

- Trade up to 5 accounts

TakeProfit Trader Current Discounts/Coupon Codes

Coupon Product(s) Discount

BUYLOW (all caps) All evaluations 40% off + no activation fee

TakeProfit Trader Restricted Countries

Afghanistan, Albania, Antarctica, Barbados, Belarus, Bosnia and Herzegovina, Bulgaria, Burkina Faso, Cameroon, Canada*, Cayman Islands, China**, Congo, Croatia, Cuba*, Ethiopia, Gibraltar, Haiti, Hong Kong**, Iran*, Iraq, Jamaica, South and North Korea*, Kosovo, Lebanon, Libyan Arab Jamahiriya, Macedonia, Mali, Mauritius, Montenegro, Morocco, Mozambique, Myanmar, Nigeria, Pakistan, Philippines, Romania, Russian Federation, Senegal, Serbia, Slovenia, Somalia, South Africa, Sudan, Syria*, Tanzania, Turkey, Turkmenistan, Uganda, Venezuela, Vietnam, Yemen, Yugoslavia, and Zimbabwe.

*Possible Exception for US Residents **Possible exception after AML review

TakeProfit Trader Commission Comparison

| ROUND TRIP | E-mini Micros | E-mini Equities | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.02 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| Purdia Capital | 1.74 | 5.68 | Varies | 7.12 | Varies | 6.12 | 14.92/6.04 |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools 2026

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!