My Funded Futures Reviews & Discounts 2024

See the most recent My Funded Futures sales and promotions for November 2024 below.

My Funded Futures (MFF) is a proprietary trading firm that offers traders the opportunity to trade with funded accounts. MFF provides a platform for both novice and experienced traders to prove their skills and potentially earn significant profits without risking their own capital. They have achieved some of the highest reviews of any prop firm of 2024 and have secured the spot of #3 on our list of top prop firms of 2024.

My Funded Futures Account Types and Evaluation Plans

MFF offers four main types of accounts:

1. Static Milestone

2. Starter

3. Starter Plus

4. Expert

My Funded Futures Static Milestone Plans: $25K, $50K, $100K, $150K

- Four account size options

- Trade up to three simfunded or funded accounts total

- Payouts at completion of each phase

- Live account at phase 5

- Static drawdown

- No daily loss limit

- No minimum trading days

- 20% max profit per day

- Micro scaling (10 micros = 1 mini)

- No recurring fees

- Trading during major economic news releases OK!

Milestone Plan Phase 1 ($25K)

In Phase 1 of the milestone plan, traders aim for a $1,500 profit target while adhering to a $1,000 static drawdown limit to manage losses effectively. To ensure consistent progress, traders must also keep daily profits below 20% of the total profit target and avoid more than seven days of inactivity.

Upon successful completion of these requirements, traders become eligible for a $750 payout.

- $1,500 profit target

- $1,000 static drawdown (loss limit)

- No more than 20% total profit in one day

- No more than 7 days of inactivity

- $750 payout after completion of phase 1

Milestone Plan Phase 2 ($25K)

In Phase 2 of the milestone plan, traders aim to achieve a $1,500 profit target while adhering to a $1,000 static drawdown limit to control risk. Additionally, traders must limit daily profits to no more than 20% of the target to promote steady gains and avoid more than 14 days of inactivity to maintain momentum.

Upon completing these requirements, a $1,000 payout is awarded.

- $1,500 profit target

- $1,000 static drawdown (loss limit)

- No more than 20% total profit in one day

- No more than 14 days of inactivity

- $1,000 payout after completion of phase 2

Milestone Plan Phase 3 ($25K)

In Phase 3 of the milestone plan, traders work toward a $1,500 profit target while staying within a $1,000 static drawdown limit to manage risk effectively. To encourage gradual progress, daily profits must not exceed 20% of the total target, and no more than 14 days of inactivity are allowed to keep the trading pace consistent.

Successfully meeting these requirements results in a $1,250 payout.

- $1,500 profit target

- $1,000 static drawdown (loss limit)

- No more than 20% total profit in one day

- No more than 14 days of inactivity

- $1,250 after completion of phase 3

Milestone Plan Phase 4 ($25K)

In Phase 4 of the milestone plan, traders aim for a $1,500 profit target while maintaining a $1,000 static drawdown limit to manage potential losses. To foster steady progress, daily profits are capped at 20% of the target, and traders must avoid more than 14 days of inactivity.

Upon completing these requirements in phase 4, a $1,250 payout is awarded.

- $1,500 profit target

- $1,000 static drawdown (loss limit)

- No more than 20% total profit in one day

- No more than 14 days of inactivity

- $1,250 payout after completion of phase 4

Milestone Plan Phase 5 ($25K)

In Phase 5 of the milestone plan, successful traders transition to a $2,500 live account, signifying the final reward for consistent progress and discipline throughout the previous phases.

This phase marks the culmination of the milestone plan, offering traders a live account to continue their growth and trading journey.

- $2,500 Live Account

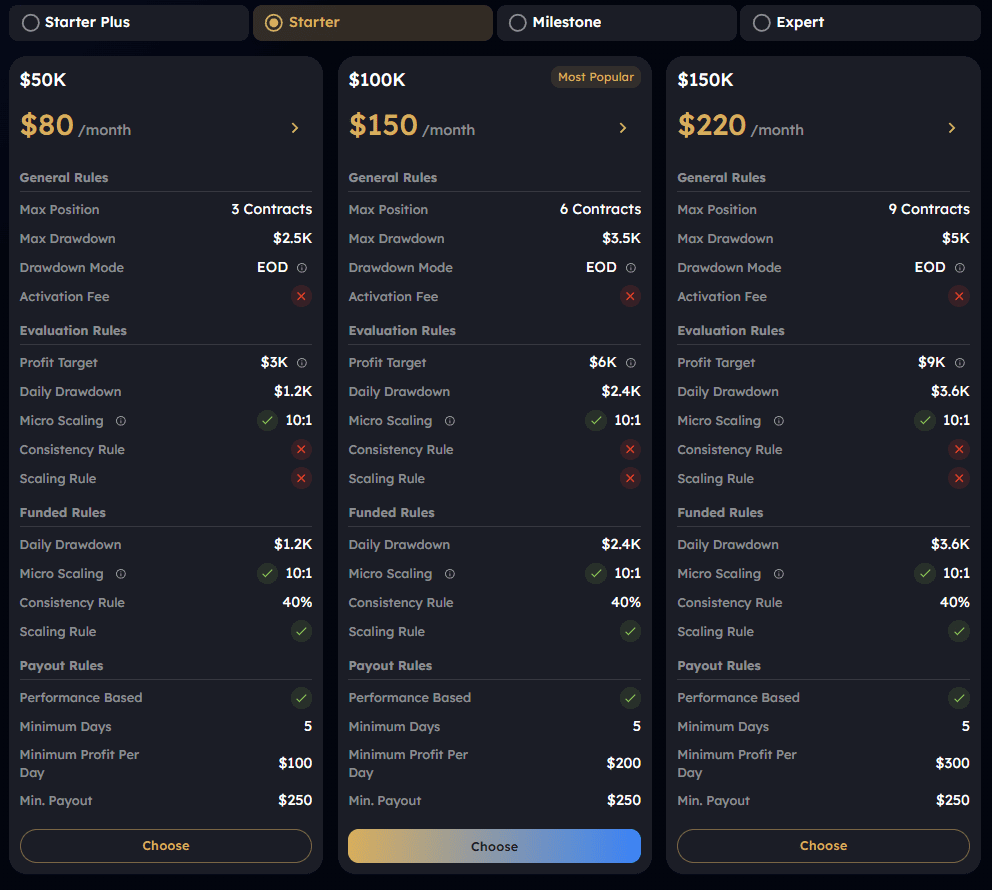

My Funded Futures Starter Evaluations: $50K, $150K, $220K

The My Funded Futures Starter Evaluation plan offers traders three account size options: $50K, $150K, and $220K. Traders can operate up to three total accounts, whether simfunded or funded, and must adhere to an end-of-day drawdown, a scaling rule, and a daily loss limit. Unique to this plan, there are no minimum trading days required to reach simfunded status, though a 40% consistency rule applies during the challenge phase.

Traders can receive weekly payouts and enjoy the flexibility of micro scaling, where 10 micros equal 1 mini. The Starter Evaluation plan is also budget-friendly, with a lower upfront cost and a reset fee below that of Starter Plus and Expert plans.

Additionally, it restricts trading around major economic news releases, with a no-trade period starting two minutes before and ending two minutes after the event.

- Three account size options

- Trade up to three simfunded or funded accounts total

- End of day drawdown

- Scaling rule

- Daily loss limit

- NO minimum trading days to sim funded

- 40% consistency rule in challenge phase

- Weekly payouts available

- NO daily loss limit

- Micro scaling (10 micros = 1 mini)

- Less expensive up front cost

- Reset Fee less than Starter Plus and Expert

- NO trading during major economic news releases (2 minutes before/after)

Starter Evaluation Options

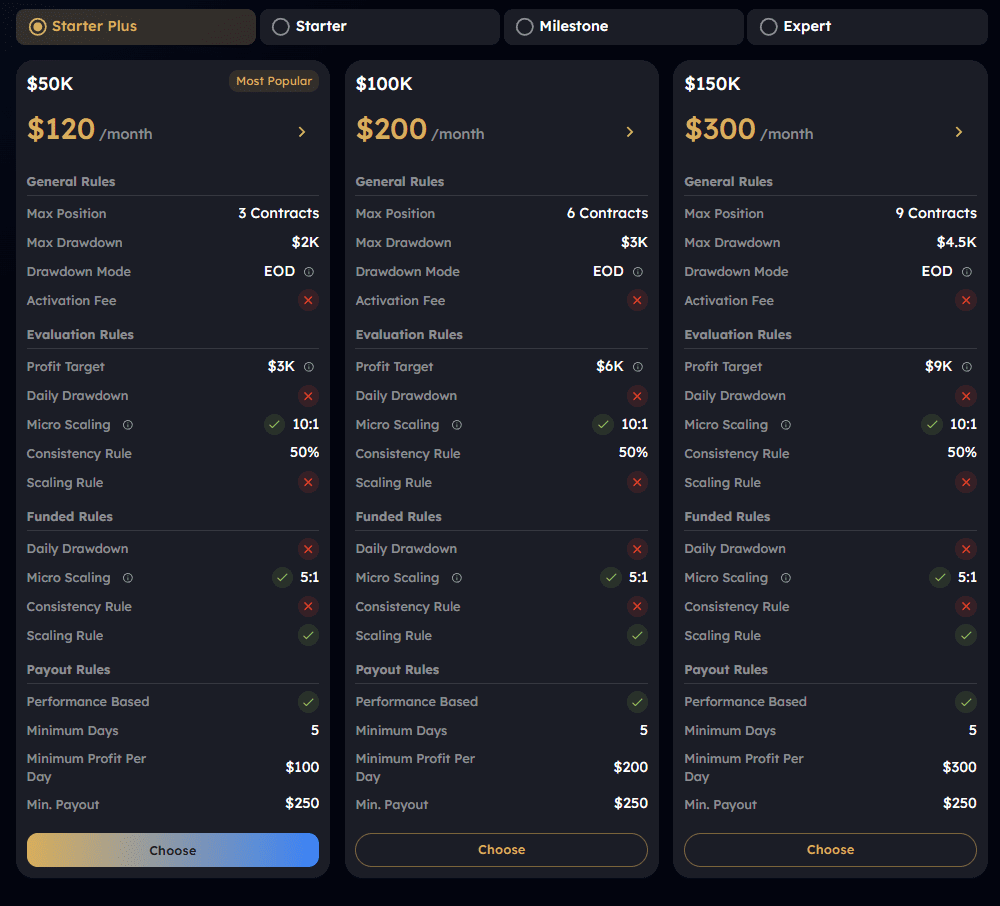

My Funded Futures Starter Plus: $50K, $100K, $150K

The My Funded Futures Starter Plus plan provides traders with three account size options: $50K, $100K, and $150K. Like the Starter plan, it allows for trading up to three accounts, whether simfunded or funded, but features slightly higher profit targets. With end-of-day drawdown, a scaling rule, and no daily loss limit, it offers robust risk management without minimum trading days needed to reach simfunded status.

The Starter Plus plan also includes quick weekly payouts and no consistency rule in the challenge phase, providing greater flexibility. Traders can utilize micro scaling, with 10 micros equaling 1 mini, and must avoid trading during major economic news releases, adhering to a two-minute window before and after.

This plan has a reset fee that is higher than Starter but lower than the Expert option.

- Three account size options

- Can trade up to 3 simfunded, or funded accounts total

- Slightly higher profit targets than Starter

- End of day drawdown

- Scaling rule

- Quick weekly payouts available

- NO daily loss limit

- NO minimum trading days to sim funded

- NO consistency rule in challenge phase

- NO daily loss limit

- NO trading during major economic news releases (2 minutes before/after)

- Micro scaling (10 micros = 1 mini)

- Reset more than Starter, less than Expert

Starter Plus Evaluation Options

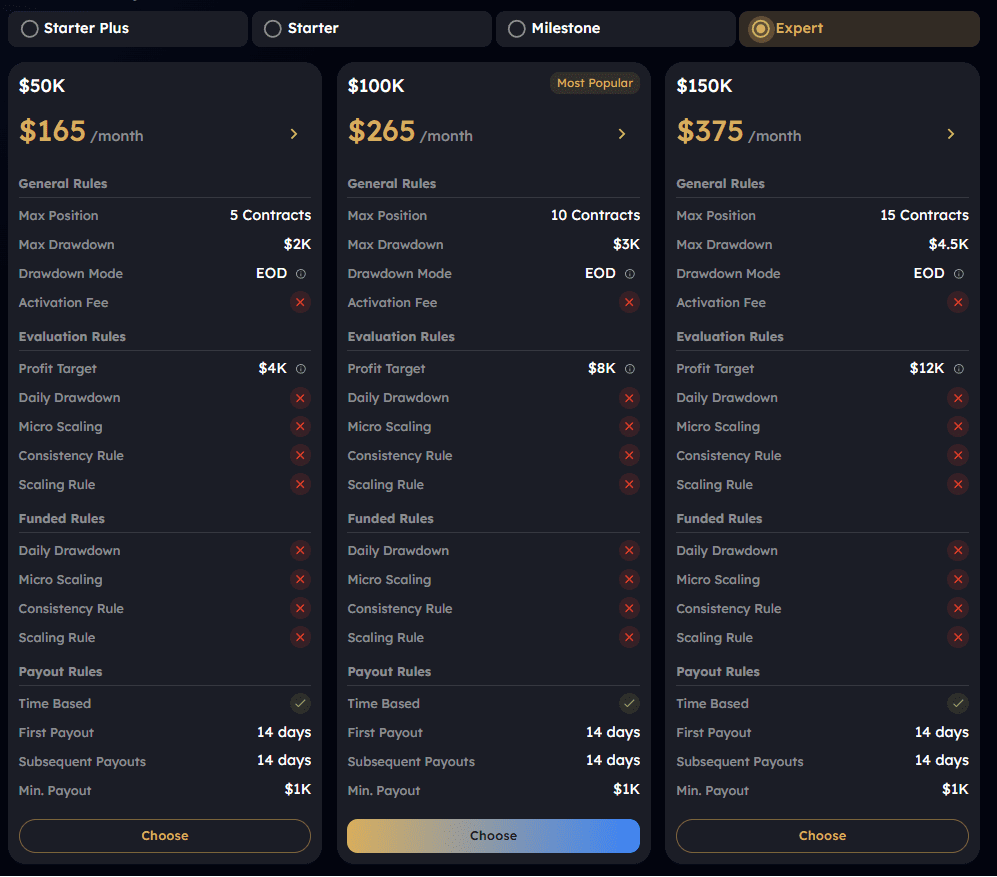

My Funded Futures Expert Evaluation Options

The My Funded Futures Expert Evaluation plan offers three account size options and allows traders to manage up to three simfunded or funded accounts. This plan has slightly higher profit targets compared to the Starter option, with an end-of-day drawdown and biweekly payouts every 14 days. Unlike other plans, it has no scaling rule, activation fee, or daily loss limit. There are no minimum trading days required to achieve simfunded status, and traders benefit from the absence of a consistency rule in both the challenge and simfunded phases.

Unlike other options, it does not offer micro scaling, so 1 micro equals 1 mini. Trading is restricted around major economic news releases, with a two-minute buffer before and after.

The Expert Evaluation has a higher reset fee compared to the Starter and Starter Plus plans.

- Three account size options

- Trade up to three simfunded or funded accounts

- Slightly higher profit targets than Starter

- End of day drawdown

- Payouts every 14 days

- NO scaling rule

- NO activation fee

- NO daily loss limit

- No minimum trading days to sim funded

- NO consistency rule in challenge phase

- NO consistency rule in the sim funded phase

- NO Micro scaling (1 micros = 1 mini)

- NO trading during major economic news releases (2 minutes before/after)

- Reset fee higher than Starter and Starter Plus

Expert Evaluation Options

My Funded Futures Evaluation Process: Starter, Starter Plus, Expert

Initial Evaluation

- Traders are provided with a virtual account

- Must meet profit targets while adhering to trading rules

- No set number of trading days

Simulated Funded Stage

- Demonstrate consistency over time

- Take payouts according to the plan’s policy

Live Funded Account

- Trade with real money in real-world scenarios

- Continue to adhere to rules and maintain profitability

- Achieve consistent success (e.g., 30 trading days for Starter accounts)

- Meet specific criteria for each account type

- Transition process reviewed by MFF

My Funded Futures Trading Parameters and Rules

2% Price Limit Rule

- Prohibits trading when a product is within 2% of a CME price limit

- Applies to Sim Funded and Live Funded accounts

News Trading Policy

- Specific rules for Tier 1 data releases per account type

Prohibited Practices

- No automated trading or high-frequency trading

- Avoid excessive risk-taking or manipulative practices

- No micro scalping

- No fully automated trading

Account Maintenance

- Must place at least one trade per seven-day cycle to keep account active

- Option to reset Starter Sim Funded accounts (maximum of three resets per account)

- Active community on Discord for trader interaction

- Public facing CEO (Matt)

- Customer support available for queries and assistance

- Educational resources and market insights provided

Trading Platforms

My Funded Futures supports multiple popular trading platforms:

- NinjaTrader (free license)

- Tradovate (free license)

- TradingView (free license)

- Quantower

- Sierra Chart

- ATAS

- Volumetrica

Automated Trading

Fully automated trading and scalping systems are not allowed. However, semi-automated systems that require manual monitoring and management are permitted.

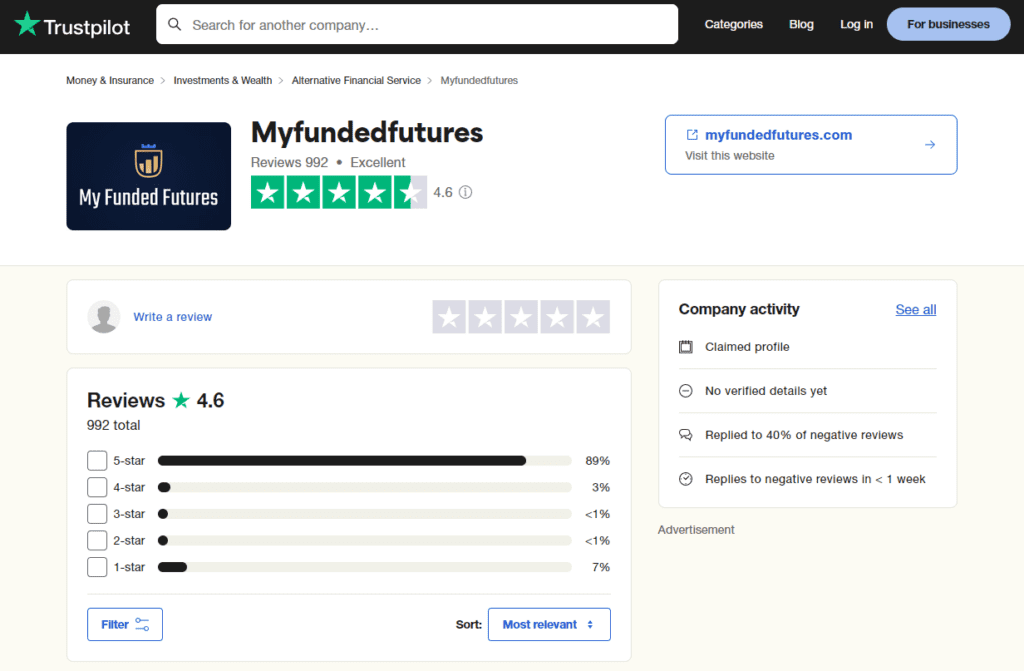

My Funded Futures TrustPilot Review Aggregation

Trustpilot Review Summary Statistics

- Total reviews analyzed: 650

- Average rating: 4.8 out of 5 stars

- 5-star reviews: 609 (93.7%)

- 4-star reviews: 11 (1.7%)

- 3-star reviews: 2 (0.3%)

- 2-star reviews: 2 (0.3%)

- 1-star reviews: 26 (4.0%)

Key Trustpilot Review Themes

Customer Support

- Described as fast, responsive, and helpful

- Most frequently mentioned positive aspect

- Many reviewers mention support staff by name, particularly GabStyle, Fytte, and Sage

- 24/7 availability highly appreciated

- Quick resolution of issues, often within minutes

Trading Rules and Conditions

- End-of-day (EOD) drawdown rules appreciated

- Frequently praised as trader-friendly and flexible

- No daily loss limits on some account types

- No minimum trading days requirement on expert accounts

- 90/10 profit split mentioned positively

Account Types and Pricing

- Competitive pricing often mentioned

- Expert and Starter plans well-received

- No activation fees on some account types (particularly expert plans)

- Promotional discounts and sales frequently mentioned

Platform and Technology

- Easy-to-use dashboard and website

- Multiple platform options (Tradovate, NinjaTrader, etc.)

- Some occasional technical issues reported, but quickly resolved

Payout Process

- Fast payouts frequently mentioned

- Some reviewers report receiving payouts within hours or days

- Use of Rise for payouts seen as efficient

Comparison to other Prop Firms

- Many reviewers state MFFU is the best futures prop firm they’ve used

- Favorable comparisons to firms like Apex, Bulenox, and others

Transparency and communication

- Active engagement on Discord appreciated

- CEO (Matt) mentioned for being accessible and responsive

Transparency and communication

- Some reviewers acknowledge MFF as a new company but express confidence in its potential

- A few mention initial launch issues that were quickly resolved

Negative Themes (less frequent but notable)

- A few complaints about account closures or payout denials

- Some confusion about specific rules or policies

- Occasional billing or payment processing issues

Additional Statistics

- Approximately 15% of reviews specifically mention fast payouts

- Around 40% of reviews highlight the quality of customer support

- About 25% of reviews compare MFFU favorably to other prop firms

- Roughly 10% of reviews mention the competitive pricing or promotional offers

Overall, the vast majority of reviewers have a very positive experience with My Funded Futures, with particular emphasis on their customer support, trader-friendly rules, and fast payouts. The company appears to be establishing itself as a strong competitor in the futures prop firm space, despite being relatively new to the market with the majority of customers being very happy with them.

Conclusion on My Funded Futures

My Funded Futures offers an attractive opportunity for futures day traders looking to access substantial capital without risking their own funds. The single-step evaluation, high profit split, and flexible program options make it appealing for various trading styles.

The fast payout processing and end-of-day drawdown calculation are significant advantages. The milestone plan add a gamified approach to trading that some traders may benefit from having defined goals and targets with no time constraints.

My Funded Futures presents a solid choice for futures traders who can meet their evaluation criteria and thrive within their trading rules and puts them at #5 on out list of Top Prop Trading firms of 2024.

Key Takeaways

- No mico scalping

- No automated trading

- End of day drawdown calculation

- Unique account offerings

- No minimum trading days to get funded

- Competitive pricing

- Multiple account options to suit your style

- Fast payouts

- Excellent customer support

- 100% profit split up to $10,000

- 90/10 profit split after the first $10,000

- Excellent trader reviews

My Funded Futures Current Discounts / Coupon Codes

Coupon Product(s) Discount End

PropPlus Starter, Starter+, Expert 5% 11/30/2024

PropPlus $25K Milestone 15% 11/30/2024

PropPlus All other Milestone 10% 11/30/2024

PropPlus Expert (Credit or Debit) 0% 11/30/2024

PropPlus Expert (Plaid) 5% 11/30/2024

My Funded Futures Restricted Countries

Afghanistan, Côte d’Ivoire, Laos, Slovenia, Albania, Crimea, Lebanon, Somalia, Algeria, Croatia, Liberia, South Sudan, Angola, Cuba, Libya, Sri Lanka, Bahamas, Democratic Republic of Congo, Mauritius, Sudan, Barbados, Ecuador, Mongolia, Syria, Belarus, Ethiopia, Montenegro, Trinidad and Tobago, Bosnia and Herzegovina, Ghana, Nicaragua, Tunisia, Botswana, Iceland, North Korea, Turkey, Bulgaria, Indonesia, Pakistan, Uganda, Burma (Myanmar), Iran, Panama, Ukraine, Burundi, Iraq, Papua New Guinea, Vietnam, Cambodia, Jamaica, Russia, Venezuela, Central African Republic, Kosovo, Serbia, Yemen, and Zimbabwe.

As of October 8th 2024, the following countries are also restricted from purchasing: Burkina Faso, Kenya, Philippines, Cameroon, Macedonia, Qatar, China, Mali, Romania, Gibraltar, Mozambique, Senegal, Haiti, Myanmar, South Africa, Hong Kong, Namibia, Tanzania, Jordan, Nigeria, and United Arab Emirates.

My Funded Futures Commission Comparison

| ROUND TRIP | E-mini Micros | Equity Futures | Currency Futures | Ag Futures | Energy Futures | Metals Futures | Crypto Futures |

|---|---|---|---|---|---|---|---|

| TakeProfit Trader | 0.5 | 5 | 5 | 5 | 5 | 5 | N/A |

| BluSky Trading | 1 | 4 | 4 | 4 | 4 | 4 | N/A |

| The Trading Pit | 1 | 3.8 | 4.44 | 5.3 | 4.24 | 4.34 | 6.24 / 1.02 micros |

| Apex (Rithmic) | 1.02 | 3.98 | 4.72 | 5.58 | 3.96 | 4.62 | 5.52 |

| Apex (Tradeovate) | 1.04 | 3.1 | 3.54 | 4.54 | 3.34 | 3.54 | 5.34 |

| Elite Trader Funding | 1.12 | 4.08 | 4.72 | 5.62 | 4.52 | 4.62 | 13.52 / 11.52 |

| TickTick (Rithmic) | 1.2 | 5 | 5 | 5 | 5 | 5 | N/A |

| TickTick (CQG) | 1.2 | 5 | 5 | 5 | 5 | 5 | N/A |

| Bluenox | 1.22 | 4.18 | 4.72 | 5.72 | 4.52 | 4.62 | 5.52 |

| My Funded Futures | 1.24 | 3.8 | 4.44 | 5.3 | 4.24 | 4.34 | 6.24 / 1.04 micros |

| TickTick (Tradeovate) | 1.54 | 4.48 | 4.48 | 4.48 | 4.48 | 4.48 | N/A |

| TradeDay | 1.54 | 4.68 | 5.12 | 6.12 | 4.92 | 5.12 | N/A |

| Uprofit | 1 | 5 | 5 | 5 | 5 | 5 | N/A |

| Tradeify | 1.74 | 5.68 | N/A | 7.12 | 5.32 | 6.12 | N/A |

How We Determine The Best Firms

In our comprehensive reviews of proprietary trading firms, we evaluate a wide range of factors to provide traders with a complete picture. We start by examining the company’s background, including its founding, leadership, and overall reputation in the industry. We then delve into the account types and sizes offered, along with the specific evaluation processes and trading conditions.

This includes analyzing profit targets, drawdown rules, and any restrictions on trading hours or instruments. We closely examine the profit-splitting structure, payout speeds, and withdrawal policies, as well as any commissions charged. The pricing model for both evaluation and funded accounts is scrutinized, including any additional fees for data feeds or platforms. We assess the trading platforms supported, any educational resources provided, and the quality of customer support. Scaling opportunities and unique features that set each firm apart are highlighted.

We also consider the overall user experience, the company’s transparency in its rules and risk disclosures, and the firm’s reputation among traders, often referencing Trustpilot scores or other review aggregators.

Our reviews aim to give traders a thorough understanding of what each prop firm offers, enabling them to make informed decisions based on their individual trading needs and preferences.

Top Trading Tools of 2024

Join our mailing list...

Be the first to receive the latest discount codes, insider deals, and special offers from the top prop trading firms—all delivered straight to your inbox. Don’t miss out on savings in the fast-paced competitive nature of these special promotions.

Join our mailing list now and stay ahead of the game!